Integration of complex risk, deep cash and liquidity functionality marks milestone for the industry

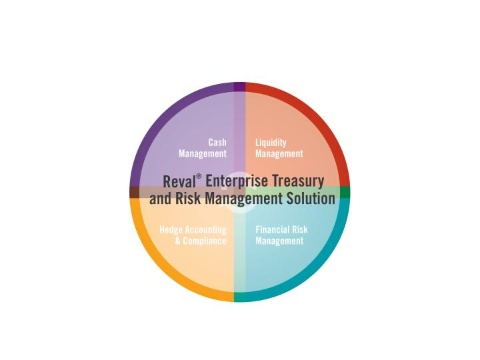

ROME--(BUSINESS WIRE)--Today at EuroFinance's International Cash and Treasury Management Conference, Reval (www.reval.com) announced the launch of its enhanced, all-in-one Software-as-a-Service (SaaS) solution for integrated enterprise treasury and risk management. The unveiling of Reval version 11.1 marks the first time complex risk and deep cash and liquidity functionality is combined into a single SaaS solution capable of managing the treasury requirements of more sophisticated organizations. Conference attendees can visit Reval at booth number L46.

"We are very excited with the launch of our single solution, which we believe can at long last deliver everything that a treasurer should expect from an enterprise treasury solution and much more," says Reval CEO and Co-founder Jiro Okochi. "Since 2008, CFO's and their treasurers have stepped up their call for the ability to better manage their financial risk, cash and liquidity, globally. Today, Reval answers that call with an all-in-one solution for total visibility." A strategic partner to over 500 companies worldwide, Reval helps financial professionals execute more effective global strategies.

Version 11.1 broadens Reval's leading financial risk management SaaS solution with the integration of cash and liquidity management functionality refined over 25 years by ecofinance, the treasury management system provider Reval acquired early this year. The combined offering meets the treasury requirements of all regions and addresses the global market need for a single, integrated solution that delivers deep and broad visibility for treasury and risk management across the enterprise.

Laurie McCulley, Managing Director of consulting firm, Treasury Strategies, explains that "As the function of treasury continues to expand and evolve into the corporate financial nerve center, organizations are increasingly looking to SaaS technology to provide visibility and control of these critical financial operations, as well as a view of risk."

Reval's SaaS includes 12 new modules for key areas of treasury, offering flexible views for global cash management and liquidity, including funding, investing, transactions and payments. It provides a single platform for all instrument capture, covering derivative, debt and investment instruments, and offers a single subledger for all treasury accounting entries.

"Treasury organizations are in transition as they reevaluate how technology can deliver the intelligence they need to support strategic decision-making," says Reval Chief Operating Officer Philip Pettinato. "Specifically, they are looking for better visibility and control into positions and exposures across business units and subsidiaries around the world. If a single SaaS platform can provide these organizations with an affordable and scalable way to adapt, optimizing treasury and risk processes across the enterprise without compromising the depth of functionality they've found in point solutions, then we will have helped usher them into a new phase of treasury management."

Reval extends its straight-through processing workflow to external systems, proactively making connections for clients to improve their user experience. To date, Reval's STP Community integrates FX trading, market data service delivering over 680 curves spanning all asset classes, bank connectivity services, and a certified SAP Service module.

As Okochi explains, "The 'Service' element of a Software-as-a-Service offering is crucially important for companies. We plan to continue to invest in our product and to provide excellent client support around the globe." Since its acquisition of ecofinance, Reval doubled its global client support team to ensure clients have 24/7 access support in every region.

For more information on the full features and benefits of Reval version 11.1, please contact info@reval.com or visit www.reval.com.

About Reval

Reval is a global provider of an all-in-one Software-as-a-Service solution for enterprise treasury and risk management. Its award-winning SaaS delivers deep and broad visibility into cash, liquidity and risk for finance, treasury and accounting groups, worldwide. With Reval's integrated, straight-through processing workflow of front-to-back office functions, companies can optimize operational efficiency, security, control and compliance across the enterprise. Reval's unique combination of deep domain expertise and comprehensive functionality provides companies with the means to compete confidently in a complex and dynamic market environment. Founded in 1999, Reval is headquartered in New York with regional centers across North America, EMEA and Asia Pacific. For more information, please visit www.reval.com.

Other suggested links: twitter.com/revalacctg4risk

# # #

Photos/Multimedia Gallery Available: http://www.businesswire.com/cgi-bin/mmg.cgi?eid=50025736&lang=en

Contacts

PR:

Peppercom

Carl Foster, +1-917-470-1564

cfoster@peppercom.com

or

Courtney Ellul, +44 (0) 79 5712 9389

cellul@peppercom.com

or

Reval Public Relations

Zoe Sochor, +1-860-799-7076

zoe.sochor@reval.com

or

Media in Germanic Region

Hannelore Hummitzsch, +43 (0) 316 908030

Hannelore.Hummitzsch@reval.com

Reval's single, integrated SaaS solution for enterprise treasury and risk management (Graphic: Business Wire).