ZURICH -- (BUSINESS WIRE) --

ABB (SWX:ABBN):

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180718005915/en/

“In the second quarter, we drove order growth in all divisions and across all regions. Through our continued productivity efforts, we delivered margin improvement and double-digit operational EPS growth,” said ABB CEO Ulrich Spiesshofer. “We completed the acquisition of GE Industrial Solutions within the committed time-frame and have started the integration at full speed together with our new colleagues.”

“With disciplined focus on relentless execution, our four divisions are continuing their drive towards world-class efficiency and effectiveness,” he added. “These results show that our transformation over the past years is delivering.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

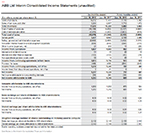

KEY FIGURES |

|

|

|

|

|

|

|

CHANGE |

|

|

|

|

|

CHANGE |

||||

|

($ in millions, unless otherwise indicated) |

|

|

|

Q2 2018 |

|

Q2 2017 |

|

US$ |

|

Compa-rable1 |

|

H1 2018 |

|

H1 2017 |

|

US$ |

|

Comparable1 |

|

Orders |

|

|

|

9,483 |

|

8,349 |

|

+14% |

|

+8% |

|

19,255 |

|

16,752 |

|

+15% |

|

+7% |

|

Revenues |

|

|

|

8,889 |

|

8,454 |

|

+5% |

|

+1% |

|

17,516 |

|

16,308 |

|

+7% |

|

+1% |

|

Operational EBITA2 |

|

|

|

1,167 |

|

1,042 |

|

+12% |

|

+8%3 |

|

2,227 |

|

1,985 |

|

+12% |

|

+6%3 |

|

as % of operational revenues |

|

|

|

13.0% |

|

12.4% |

|

+0.6pts |

|

|

|

12.7% |

|

12.3% |

|

+0.4pts |

|

|

|

Net income |

|

|

|

681 |

|

525 |

|

+30% |

|

|

|

1,253 |

|

1,249 |

|

0% |

|

|

|

Basic EPS ($) |

|

|

|

0.32 |

|

0.25 |

|

+30%4 |

|

|

|

0.59 |

|

0.58 |

|

+1%4 |

|

|

|

Operational |

|

|

|

0.38 |

|

0.30 |

|

+28%4 |

|

+27%4 |

|

0.69 |

|

0.58 |

|

+19%4 |

|

+16%4 |

|

Cash flow from operating activities |

|

|

|

1,010 |

|

467 |

|

+116% |

|

|

|

492 |

|

976 |

|

-50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Short-term outlook

Macroeconomic signs are trending positively in Europe and the United States, with growth expected to continue in China. The overall global market is growing, with rising geopolitical uncertainties in various parts of the world. Oil prices and foreign exchange translation effects are expected to continue to influence the company’s results.

Q2 2018 Group results

Orders

Total orders rose 8 percent (14 percent in US dollars), up in all divisions and regions compared to a year ago. Base orders (classified as orders below $15 million) increased 9 percent (14 percent in US dollars), up in all divisions and regions. Large orders represented 7 percent of total orders, compared to 8 percent in the same quarter of 2017. ABB’s comprehensive digital offering, ABB Ability™, was a significant contributor to the quarter’s order growth.

The book-to-bill ratio increased to 1.07x at the end of the quarter compared with 0.99x in the previous year.

Service orders were up 2 percent (5 percent in US dollars) on a tough comparable period. Service orders represent 19 percent of total orders, compared to 20 percent in the prior year period.

Changes in the business portfolio related to the acquisition of B&R resulted in a net positive impact of 3 percent on total reported orders. A stronger US dollar versus the prior year period provided a 3 percent positive translation impact on reported orders.

Market overview

ABB saw strong demand from all regions in the quarter:

- Total orders from Europe rose 10 percent (22 percent in US dollars), with positive contribution from Germany, Italy, the UK, Norway, Spain and France more than offsetting declines in Sweden, Finland and Switzerland. Base orders rose 12 percent (24 percent in US dollars) with Italy and the UK as the main contributors.

- The Americas delivered a 7 percent rise in total orders (7 percent in US dollars). Higher orders were recorded in the United States, Canada and Mexico. Base orders increased 7 percent (7 percent in US dollars). The United States grew, on a comparable basis, 6 percent (7 percent in US dollars) in total order terms and 7 percent (8 percent in US dollars) in base orders.

- In Asia, Middle East and Africa (AMEA), total orders grew 7 percent (11 percent in US dollars) with good order demand from China, India and the UAE. Base orders rose 7 percent (12 percent in US dollars) with positive contributions from China, India and Australia more than offsetting lower intake from South Korea and South Africa. In China, total and base orders increased 20 percent and 23 percent (29 percent and 32 percent in US dollars) respectively.

Demand grew in the majority of ABB’s key customer segments:

- Utility demand was mixed in the second quarter. Activity related to grid integration for renewables and investments in improving grid reliability, particularly through digitalization, continued to grow. Larger grid investments, for example in long distance transmission, remained subdued.

- Industrial demand grew well across a broad customer base in the quarter. Process industries, including oil and gas and mining, continued to increase investments, with capex concentrated on upgrading and automating brown-field assets. An ongoing focus on select industries such as food and beverage and automotive, proved beneficial for order momentum, particularly ABB’s automation and robotics solutions.

- Transport and infrastructure demand was solid, with good orders received for rail electrification, from the construction sector and in specialty vessels. Highlights for the quarter include continued strong growth in data centers and for electric vehicle fast-charging solutions.

Revenues

Revenues were up 1 percent (5 percent higher in US dollars), well-supported by continued solid growth in Robotics and Motion and Electrification Products. This was tempered by steady revenues in Industrial Automation and lower revenues in Power Grids due to the lower opening order backlog in both divisions.

Service revenues were up 13 percent (16 percent in US dollars), and represented 19 percent of total revenues, up from 17 percent in the prior year period. Services growth was bolstered by ABB’s leading digital portfolio, ABB Ability™ solutions.

Change in exchange rates resulted in a positive translation impact on reported revenues of 2 percent. Business portfolio changes had a net positive effect of 2 percent on reported revenues.

Operational EBITA

Operational EBITA of $1,167 million increased 8 percent in local currencies (12 percent in US dollars) in the second quarter. The operational EBITA margin increased 60 basis points to 13 percent, supported by continued productivity efforts. ABB continued to invest in its sales, brand and ABB Ability™ over the quarter.

Net income, basic and operational earnings per share

Net income was $681 million, up 30 percent compared to the prior year’s $525 million. ABB’s operational net income2 rose 27 percent to $810 million. Basic earnings per share of $0.32 was 30 percent higher year-on-year. Operational earnings per share of $0.38 was up 28 percent, and 27 percent better in constant currency terms4.

Cash flow from operating activities

The cash flow from operating activities result of $1,010 million compares to $467 million in the second quarter of 2017. Relative to a year ago, cash flow primarily reflects a change in the timing of employee incentive payments paid in the first quarter this year which in 2017 were paid in the second quarter. ABB expects solid cash delivery for the full year.

Q2 divisional performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

($ in millions, unless otherwise indicated) |

|

|

|

Orders |

|

CHANGE |

|

3rd party base orders |

|

CHANGE |

|

Revenues |

|

CHANGE |

|

Op EBITA % |

|

CHANGE |

||||||

|

|

|

|

|

US$ |

|

Compa-rable1 |

|

|

US$ |

|

Comparable1 |

|

|

US$ |

|

Comparable1 |

|

|

||||||

|

Power Grids |

|

|

|

2,577 |

|

+6% |

|

+5% |

|

2,128 |

|

+9% |

|

+7% |

|

2,354 |

|

-6% |

|

-8% |

|

9.7% |

|

-0.4pts |

|

Electrification Products |

|

|

|

2,727 |

|

+9% |

|

+6% |

|

2,553 |

|

+7% |

|

+4% |

|

2,673 |

|

+7% |

|

+4% |

|

16.0% |

|

+1.0pts |

|

Industrial Automation |

|

|

|

2,005 |

|

+34% |

|

+15% |

|

1,715 |

|

+30% |

|

+9% |

|

1,839 |

|

+17% |

|

0% |

|

14.1% |

|

+0.7pts |

|

Robotics and Motion |

|

|

|

2,540 |

|

+15% |

|

+11% |

|

2,363 |

|

+20% |

|

+16% |

|

2,316 |

|

+11% |

|

+8% |

|

16.1% |

|

+1.0pts |

|

Corporate & other |

|

|

|

(366) |

|

|

|

|

|

35 |

|

|

|

|

|

(293) |

|

|

|

|

|

|

|

|

|

ABB Group |

|

|

|

9,483 |

|

+14% |

|

+8% |

|

8,794 |

|

+14% |

|

+9% |

|

8,889 |

|

+5% |

|

+1% |

|

13.0% |

|

+0.6pts |

|

Effective January 1, 2018, management responsibility and oversight of certain remaining engineering, procurement and construction (EPC) business, previously included in the Power Grids, Industrial Automation, Robotics and Motion operating segments, were transferred to a new non-core operating business within Corporate and Other. Previously reported amounts have been reclassified consistent with this new structure. |

|

|

Power Grids

Momentum in third-party base order growth continued, rising 7 percent (9 percent in US dollars). Total orders were up 5 percent (6 percent in US dollars). Power Up initiatives and ABB Ability™ solutions gained traction. Renewables, grid digitalization and pick up in industrial and transportation sectors contributed to the growth. At the end of the second quarter, the order backlog was 4 percent lower (6 percent in US dollars) versus the prior year period. Revenues were 8 percent lower (6 percent in US dollars), dampened by the lower opening order backlog. Operational EBITA margin was 9.7 percent, mainly due to lower revenues and investment in the ongoing Power Up program. Cost management initiatives are in place.

Electrification Products

Total orders increased 6 percent (9 percent in US dollars) and third-party base orders improved 4 percent (7 percent in US dollars). Order growth was broad based, with all business units, particularly products, performing well across all regions. Revenues increased 4 percent (7 percent in US dollars). Operational EBITA margins expanded 100 basis points year-on-year, benefiting from pricing actions and sustained productivity efforts.

Industrial Automation

Total orders (including B&R and currency effects) were up 34 percent and third-party base orders were up 30 percent compared to the prior year period. On a comparable basis, total orders rose 15 percent and third-party base orders increased 9 percent. Investments continued for specialty vessels as well as selective investments in process industries, particularly oil and gas. Base orders grew across all industries, with double digit growth in service. At the end of the second quarter, the order backlog was 4 percent lower (1 percent lower in US dollars) versus the prior year period. Revenues were stable in the quarter, reflecting revenues from strong product orders offsetting the lower opening order backlog. The operational EBITA margin improved by 70 basis points, supported by a positive mix and strong project execution.

Robotics and Motion

Third-party base orders increased 16 percent (20 percent in US dollars) and total orders increased 11 percent (15 percent in US dollars) in the quarter. Order growth was achieved across all business units and regions, with demand from process industries continuing the recovery trend. Revenues increased 8 percent (11 percent in US dollars). Operational EBITA margin expanded 100 basis points year-on-year to 16.1 percent, due to positive volumes and mix as well as continued productivity efforts.

Next Level strategy

Since 2014, ABB has been executing its Next Level strategy, focusing on profitable growth, relentless execution and business-led collaboration. In the past years, ABB has shaped its divisions into four market-leading, entrepreneurial units; has driven a quantum leap in digital through ABB Ability™; has accelerated momentum in operational excellence; and has strengthened ABB’s brand.

All of ABB’s divisions are driving profitable growth within key markets, with new and existing end-to-end digital ABB Ability™ solutions, able to close the loop with connected devices and build on the intelligent cloud. The divisions continue to focus on relentless execution, building on existing momentum and continuing to invest in growth, with stronger links between compensation and delivery of operational performance.

Today, ABB is better positioned in better markets, with a streamlined and strengthened portfolio that offers two clear value propositions: bringing electricity from any power plant to any plug, and automating industries from natural resources to finished products.

Profitable growth

ABB’s digital solutions offering, ABB Ability™, is integral to the company’s efforts to drive profitable growth. The offering includes more than 210 ABB Ability™ solutions, meeting the needs of customers in utilities, industry and transport & infrastructure. During the quarter ABB received an order from Danish green energy company Ørsted, to integrate offshore wind power with the UK power grid. As part of the order, ABB will supply its market-leading ABB Ability™ digital grid solutions to ensure power reliability and efficiency. As well, for example, ABB is working with China’s Yitai Group, a chemicals company. ABB will supply end-to-end ABB Ability™ solutions that will enable top-tier productivity levels in their new plants. This is the first order in a series of digital projects for Yitai Group.

During the second quarter ABB announced an investment of €100 million in an R&D facility and training campus in Eggelsberg, Austria, which will drive innovation in machine and factory automation including artificial intelligence and machine learning. ABB also announced an investment of around $30 million in a new state-of-the-art manufacturing unit for Power Grids’ transformer offering in Sweden.

Update on the acquisition of GE Industrial Solutions (GEIS)

Through ongoing portfolio management, ABB is shifting its center of gravity. The Group completed its acquisition of GE Industrial Solutions (GEIS) on June 30, 2018. By acquiring GEIS, ABB is strengthening the group’s number two position in electrification globally, and increasing the group’s exposure to the attractive North American market – already ABB’s biggest market – and early cycle business. GEIS is being integrated into ABB’s Electrification Products (EP) division as a new business unit called Electrification Products Industrial Solutions (EPIS). Headquartered in Atlanta, Georgia, EPIS has about 14,000 employees around the world.

Approximately $200 million of annual cost synergies are expected by year five. ABB will realize value through product and technology portfolio harmonization, particularly from coupling ABB Ability™ offerings with the extensive installed base. Synergies will also be extracted from footprint optimization, supply chain savings and SG&A cost reduction. It is expected that the integration of GEIS will have an approximately 60 basis points negative impact on ABB Group operating EBITA margins in the second half of 2018 and approximately 260 basis points on the EP operating EBITA margin. ABB aims to bring the margin for the EP division, after an initial dampening effect, back into its operational EBITA margin target range of fifteen to nineteen percent during 2020. The transaction includes a long-term strategic supply relationship with GE and allows ABB long-term use of the GE brand.

Relentless execution

ABB continues to benefit from its ongoing cost management and productivity efforts. During the quarter, pricing action and savings outpaced raw materials inflation supporting ABB’s ongoing aim of offsetting three to five percent of the group’s cost of sales each year.

The group focus on Quality and Operations is building on ABB’s 1,000-day programs completed in 2017. Gaps in performance, informed by customer feedback, are rigorously identified and addressed using Lean Six Sigma methods. ABB currently has 1,500 continuous improvement projects underway, led from within each division.

Business-led collaboration

Strategic partnership developments in the second quarter include the formation of a global strategic alliance to provide industrial grade edge data center solutions between ABB and Rittal, building on the success of prior co-operation and a software alliance for collaborative robotics with Kawasaki Heavy Industries.

ABB continues to build strategic brand positioning through its partnership with the ABB Formula E electric car racing championship series, which provides a unique platform to demonstrate e-mobility leadership.

Short- and long-term outlook

Macroeconomic signs are trending positively in Europe and the United States, with growth expected to continue in China. The overall global market is growing, with rising geopolitical uncertainties in various parts of the world. Oil prices and foreign exchange translation effects are expected to continue to influence the company’s results.

The attractive long-term demand outlook in ABB’s three major customer sectors – utilities, industry and transport & infrastructure – is driven by the Energy and Fourth Industrial Revolutions. ABB is well-positioned to tap into these opportunities for long-term profitable growth with its strong market presence, broad geographic and business scope, technology leadership and financial strength.

More information

The Q2 2018 results press release and presentation slides are available on the ABB News Center at www.abb.com/news and on the Investor Relations homepage at www.abb.com/investorrelations.

ABB will host a media call today starting at 10:00 a.m. Central European Time (CET) (9:00 a.m. BST, 4:00 a.m. EDT). The event will be accessible by conference call. Lines will be open 10-15 minutes before the start of the call. The media conference call dial-in numbers are:

UK +44 207 107 0613

Sweden +46 8 5051 0031

Rest of Europe, +41 58 310 5000

US and Canada +1 866 291 4166 (toll-free) or +1 631 570 5613 (long-distance charges)

A conference call and webcast for analysts and investors is scheduled to begin today at 2:00 p.m. CET (1:00 p.m. BST, 8:00 a.m. EST). Callers are requested to phone in 10 minutes before the start of the call. The analyst and investor conference call dial-in numbers are:

UK +44 207 107 0613

Sweden +46 8 5051 0031

Rest of Europe, +41 58 310 5000

US and Canada +1 866 291 4166 (toll-free) or +1 631 570 5613 (long-distance charges)

The call will also be accessible on the ABB website at: https://new.abb.com/investorrelations/second-quarter-2018-results-webcast. A recorded session will be available as a podcast one hour after the end of the conference call and can be downloaded from our website.

ABB (ABBN: SIX Swiss Ex) is a pioneering technology leader in power grids, electrification products, industrial automation and robotics and motion, serving customers in utilities, industry and transport & infrastructure globally. Continuing a history of innovation spanning more than 130 years, ABB today is writing the future of industrial digitalization with two clear value propositions: bringing electricity from any power plant to any plug and automating industries from natural resources to finished products. As title partner in ABB Formula E, the fully electric international FIA motorsport class, ABB is pushing the boundaries of e-mobility to contribute to a sustainable future. ABB operates in more than 100 countries with about 147,000 employees. www.abb.com

|

|

|

|

||

|

|

|

|

|

INVESTOR CALENDAR 2018/2019 |

|

Third quarter 2018 results |

|

|

|

October 25, 2018 |

|

Fourth quarter and full year 2018 results |

|

|

|

February 2019 |

|

|

Important notice about forward-looking information

This press release includes forward-looking information and statements as well as other statements concerning the outlook for our business, including those in the sections of this release titled “Short-term outlook”, “Cash flow from operating activities”, “Next Level strategy” and “Short- and long-term outlook”. These statements are based on current expectations, estimates and projections about the factors that may affect our future performance, including global economic conditions, the economic conditions of the regions and industries that are major markets for ABB Ltd. These expectations, estimates and projections are generally identifiable by statements containing words such as “expects,” “believes,” “estimates,” “targets,” “plans,” “is likely”, “intends” or similar expressions. However, there are many risks and uncertainties, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking information and statements made in this press release and which could affect our ability to achieve any or all of our stated targets. The important factors that could cause such differences include, among others, business risks associated with the volatile global economic environment and political conditions, costs associated with compliance activities, market acceptance of new products and services, changes in governmental regulations and currency exchange rates and such other factors as may be discussed from time to time in ABB Ltd’s filings with the U.S. Securities and Exchange Commission, including its Annual Reports on Form 20-F. Although ABB Ltd believes that its expectations reflected in any such forward-looking statement are based upon reasonable assumptions, it can give no assurance that those expectations will be achieved.

Zurich, July 19, 2018

Ulrich Spiesshofer, CEO

ABB CEO Ulrich Spiesshofer discusses the company's second quarter 2018 results.

|

________ |

|

1Growth rates for orders, third-party base orders and revenues are on a comparable basis (local currency adjusted for acquisitions and divestitures). US$ growth rates are presented in Key Figures table. |

|

2 For non-GAAP measures, see the “Supplemental Financial Information” attachment to the press release. |

|

3Constant currency (not adjusted for portfolio changes). |

|

4EPS growth rates are computed using unrounded amounts. Comparable operational earnings per share is in constant currency (2014 exchange rates not adjusted for changes in the business portfolio). |

![]()

View source version on businesswire.com: https://www.businesswire.com/news/home/20180718005915/en/

CONTACT:

ABB Ltd

Affolternstrasse 44

8050 Zurich

Switzerland

Media Relations

Phone: +41 43 317 71 11

E-mail: media.relations@ch.abb.com

or

Investor Relations

Phone: +41 43 317 71 11

E-mail: investor.relations@ch.abb.com