TOKYO--(BUSINESS WIRE)--MSCI Inc. (NYSE:MSCI), a leading provider of investment decision support tools worldwide, announced today that it has completed a research mandate for Japan’s Government Pension Investment Fund (GPIF) that examines uses of factor-based indexes in large institutional portfolios and evaluates passive implementation of factor strategies alongside traditional passive and active mandates.

“We are happy to have been recognized by some of the world’s largest asset owners, including GPIF and Norway’s Ministry of Finance, for our expertise in factor indexes,” said Baer Pettit, Managing Director and Global Head of MSCI’s index business. “The study commissioned by GPIF reveals that passive factor strategies, which are made possible through newly developed factor indexes, and active management are not mutually exclusive. As a result, sophisticated institutional investors may increasingly make an independent allocation to passive factor investments, in parallel to their existing active and passive mandates.”

Chin Ping Chia, Head of Index Applied Research for MSCI in Asia Pacific, added, “As factor-based investing becomes more common among institutional investors, there is a growing need to understand how it can be best integrated into the existing investment process. In this research we studied the historical performance of investable factor indexes and observed that passive factor strategies can be implemented as a potential ‘third bucket’ alongside the traditional active and passive allocations.”

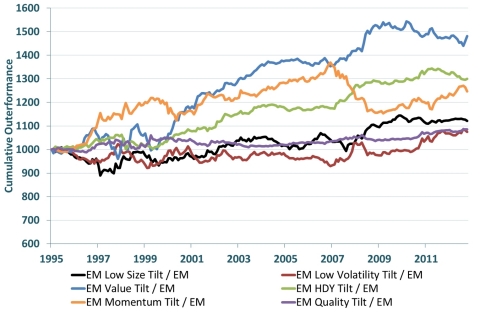

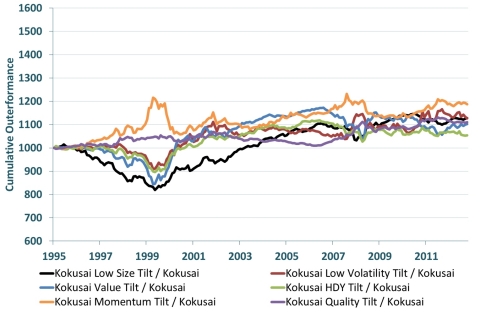

For the purposes of the research, MSCI created a series of factor indexes designed for large-scale asset owners and managers, for whom investability is a critical consideration. These indexes reweighted all the constituents of a market cap index based on six systematic factors – Value, Low Size, Low Volatility, High Yield, Quality and Momentum. MSCI also analyzed various multi-factor indexes to show the different historical performance characteristics of different combinations.

In April, GPIF announced that it had selected the MSCI Japan Index for a core Japanese equity passive fund. The MSCI Japan Small Cap Index was also selected for one of the index-based strategies in GPIF’s domestic equity program. Additionally, GPIF has announced that it intends to introduce a factor allocation in addition to its existing active and passive mandates.

Equity factor investing was pioneered in the 1970s based on research, data and analytics created by Barra – today an MSCI company. In recent years, MSCI has developed a range of indexes that provide institutional investors with a basis for implementing a transparent and efficient passive approach to seeking the excess returns historically obtained over long time horizons through active factor investing. In 2008, MSCI introduced the industry’s first Minimum Volatility Index. More than USD 90 billion in assets are benchmarked to MSCI Factor Indexes1.

1As of March 31, 2014, according to eVestment, Lipper and Bloomberg.

About MSCI

MSCI Inc. is a leading provider of investment decision support tools to investors globally, including asset managers, banks, hedge funds and pension funds. MSCI products and services include indexes, portfolio risk and performance analytics, and ESG data and research.

The company’s flagship product offerings are: the MSCI indexes with over USD 9 trillion estimated to be benchmarked to them on a worldwide basis1; Barra multi-asset class factor models, portfolio risk and performance analytics; RiskMetrics multi-asset class market and credit risk analytics; IPD real estate information, indexes and analytics; MSCI ESG (environmental, social and governance) Research screening, analysis and ratings; and FEA valuation models and risk management software for the energy and commodities markets. MSCI is headquartered in New York, with research and commercial offices around the world.

1As of March 31, 2014, as reported in June 2014 by eVestment, Lipper and Bloomberg.

For further information on MSCI, please visit our web site at www.msci.com.