BARCELONA, Spain--()--Temenos (SIX:TEMN), the market leading provider of banking software, today announces the evolution of its T24 Enterprise vision, known as Temenos Enterprise Frameworks Architecture (TEFA) – which lays the foundation for the future development of modular banking components.

TEFA is fundamental to supporting Temenos’ vision to provide a complete universal banking solution, ‘out of the box’, with banking components suitable for all banks, everywhere. It is based on standard software, so banks can invest with confidence in proven products with clear roadmaps and dedicated support. TEFA addresses the major challenges banks face: it enables banks to better know and serve their customers; to comply with regulatory requirements; and to reduce the cost of deploying, maintaining and upgrading banking systems – greatly reducing transaction costs. Because TEFA represents an evolution of the existing T24 architecture, customers can incrementally adopt it, reducing risk and cost.

John Schlesinger, Chief Enterprise Architect, Temenos, says: “Temenos is not about reinventing the wheel. Nor are we distracted by building middleware or workflow, or other generic software. We’re solely focused on developing award-winning banking software for the world’s leading banks. What we are developing in TEFA leverages and builds on our 20 year investment in T24, combined with a super partner ecosystem – it’s a true ‘out of the box’ universal banking platform, with banking components for institutions of any size. We are committed to lowering the TCO for our customers, while enabling banks to compete through innovation. TEFA paves the way for tier one banks to renovate their core banking systems in a controlled, incremental way.”

TEFA is delivered via an evolutionary roadmap set to roll-out over the next three years. Two of the frameworks – Platform framework and Integration framework – are available in the latest version of T24, Release 12, also launched today. The Integration and Design frameworks will be available in T24 R13, and the Data and Component frameworks will be brought online within the next three years.

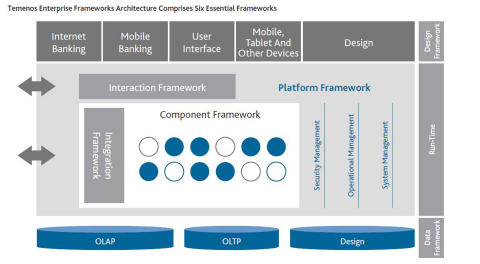

A fully-componentised banking platform, TEFA is based on six frameworks:

Component framework: Separates individual modules within the T24 suite into individual, best-of-breed modular banking products. Banks can deploy exactly and only the solutions they need, without the need to replace the entire core banking system. This reduces the risk of change for banks and renders upgrades firmly in banks’ control. Due to the ‘AppStore’ nature of the componentised architecture, third party applications can be swiftly incorporated into the suite, fuelling continuous innovation.

Interaction framework: Enables a world class user interface and experience to banks and banks’ customers. User interfaces are changing more rapidly than banking capability. Supporting banks to meet this challenge, TEFA separates the user interface from the banking capability, to deliver a flexible interface with the agility to meet continuously evolving customer and employee requirements. If an enterprise is running multiple software platforms including T24, the interaction framework can mash-up all these systems to create user agents that match exactly the needs of the bank.

Integration framework: Moves integration from the banking capability to an integration hub, allowing many-to-many integration, rather than one-to-one. This code-free integration dramatically speeds up implementation time, meaning banks can boost their competitive edge by bringing new capabilities to market faster. By subjecting every transaction to a pre-defined set of business rules, the integration framework ensures that each transaction has only one possible consequence in the core banking system but possibly many consequences in the enterprise, these being taken care of by the integration middleware.

Data framework: Separates transactional data from reporting data to optimise processing efficiency and data visibility. As banking shifts from in-branch to internet and mobile channels, the look-to-book ratio will dramatically increase by as much as 100-fold. In order to provide meaningful information to customers, banks need to separate read-only from read-write data and only back-up the data that changes. Banks who cannot separate this out will start to drown in the data deluge as databases exceed five terabytes. Banks who achieve this data separation will be able to store all customers’ transactions online, not just a few months’ worth, and so provide better customer service. The transactional database will also become much smaller in volume, which will help banks’ move into the cloud.

Design framework: Separates design-time from run-time data, in a model-driven development environment. Designing and implementing a new banking capability within a live production system is fraught with risk – the risk of impacting the performance of live transaction processes, and the risk of modifying live data or structures. Model-driven development reduces this risk and reduces the time to configure and customise banking systems and improves the time to market.

Platform framework: Separates commodity resource management capabilities from banking capability so that the platform is technology-independent and commodity skills are all that is required to run core banking systems. Temenos is committed to providing banks with the freedom to choose complementary systems and the platform framework allows banks to easily adopt new operating models including running applications in the cloud and integration of mobile functionality. The platform framework enables Temenos to support its platform partners’ products rather than having to provide its own middleware, reducing the skills needed by the banks and giving them greater choice.

About Temenos

Founded in 1993 and listed on the Swiss Stock Exchange (SIX:TEMN), Temenos Group AG is the market leading provider of banking software systems to retail, corporate, universal, private, Islamic, microfinance and community banks, wealth managers, and financial institutions. Headquartered in Geneva with more than 60 offices worldwide, Temenos is proven in over 1,500 customer deployments in more than 125 countries across the world. Temenos’ software products provide advanced technology and rich functionality, incorporating best practice processes that leverage Temenos’ expertise around the globe. Temenos customers are proven to be more profitable than their peers: as of April 2012 – over the last 3 years Temenos customers have enjoyed on average a 30% higher return on assets, a 46% higher return on capital and a cost/income ratio that is 8.5 points lower than non-Temenos customers.

For more information please visit www.temenos.com

Photos/Multimedia Gallery Available: http://www.businesswire.com/cgi-bin/mmg.cgi?eid=50286790&lang=en