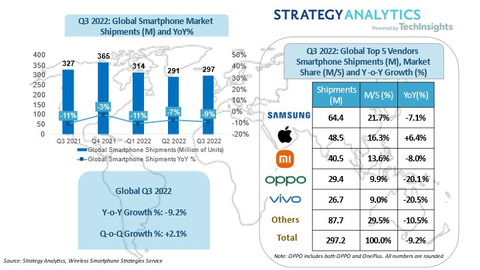

BOSTON--(BUSINESS WIRE)--According to new research from Strategy Analytics, global smartphone shipments fell -9% YoY to 297 million units in Q3 2022. Samsung topped the global smartphone market with a healthy 22% share in Q3 2022. Apple ranked the second place with 16% share, the highest third quarter performance over the past twelve years. Xiaomi, OPPO (including OnePlus) and vivo stayed in the top five list.

Linda Sui, Senior Director at Strategy Analytics, said, “Global smartphone shipments fell -9% YoY to 297 million units in Q3 2022. This is the fifth consecutive quarter of annual decline by smartphone volumes. Inventory adjustments and geopolitical issues adversely impacted smartphone market in the third quarter of this year. Meanwhile, unfavorable economic conditions continued to weaken consumers’ demand on smartphones and other non-essential products.”

Woody Oh, Director at Strategy Analytics, added, “We estimate Samsung shipped 64 million smartphones and topped the global smartphone market with a healthy 22% share in Q3 2022. It slightly outperformed the total market and declined -7% YoY by shipment volumes. Demand tilted towards low- cost A and M series, while the newly launched Z Fold 4 and Z Flip 4 help the company strengthen the leadership in foldable segment. Apple shipped 49 million iPhones worldwide, up +6% YoY, for 16% global marketshare in Q3 2022. This is the highest third quarter market share for Apple over the past twelve years, at the expense of leading Chinese brands who are hampered by the sluggish performance in both home and overseas market. Apple had a good quarter, led by newly launched iPhone 14 Pro and Pro Max, while the demand for iPhone 14 remained mixed.”

Yiwen Wu, Senior Analyst at Strategy Analytics, added, “Xiaomi shipped 40.5 million smartphones and took third place with nearly 14% global marketshare in Q3 2022, slightly up from one year ago. Xiaomi outperformed other major Chinese brands and registered -8% annual decline rate, thanks to the well diversified regional footprint. However, Xiaomi continued suffering from the geopolitical uncertainties in Europe. China and India market also delivered a mixed bag for the Chinese brand. OPPO (OnePlus) held fourth spot and captured 10% global smartphone marketshare during Q3 2022. Vivo stayed fifth with 9% global smartphone marketshare in Q3 2022. OPPO (OnePlus) and Vivo both posted a double digit annual decline rate and lost ground in most markets, as 4G and 5G competition intensified sharply in China and other markets.”

Neil Mawston, Executive Director at Strategy Analytics, added, “Global competition among other major smartphone brands, beyond the top-five, was fierce during Q3 2022. Transsion, Honor, Realme, Lenovo-Motorola and Huawei ranked the top ten list but delivered mixed results this quarter. Transsion maintained the sixth position and saw a healthy growth in Central Eastern Europe and Central Latin America region, but smartphone shipments posted double digit annual decline rate this quarter blaming the soft performance in Asia Pacific and Africa Middle East region. Honor’s impressive resilient journey also hit a pause and delivered annual decline due to the pull back in China in Q3 2022. Realme registered a double-digit annual decline and lost ground in all regions except Central Eastern Europe where it benefited from the industry reshuffle. Lenovo-Motorola stayed in the top ten list but also delivered an annual decline while it witnessed a solid growth in Asia Pacific region mainly in India. Huawei in contrast posted an annual growth by smartphone shipment this quarter, mainly driven by the healthy demand of 4G enable smartphones in China, such as Nova 10 series, P50 and Mate 50 models. Among top ten brands, there are eight Chinese brands. However, all these Chinese brands combined posted -13% annual decline, underperforming total market and the top two players.”

Linda Sui, Senior Director at Strategy Analytics, added, “We forecast global smartphone shipments to decline -9% to -10% YoY in full-year 2022. Geopolitical issues, economy downturn, energy shortage and price hike, exchange rate volatility, and Covid disruption will continue to weaken consumer demand during the last quarter of 2022. All these headwinds would continue through the first half of next year, before the situation eases in the second half of 2023. Samsung and Apple would continue to outperform and remain top two places. Chinese brands need to stabilize the performance in China market and explore new growth engine to terminate the falling track.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

For more information about Strategy Analytics

Wireless Smartphone Strategies Service: Click Here

|

1 Numbers are rounded. |