HONG KONG--(BUSINESS WIRE)--Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three month and twelve month periods ended 31 December 2021. (All amounts are expressed in HKD unless otherwise stated)

LETTER FROM THE CHAIRMAN OF GALAXY ENTERTAINMENT GROUP

I would like to take this opportunity to provide you with a broad market overview and to review the financial performance of GEG in 2021. Macau like the rest of the world continued to experience the impact of COVID-19 throughout 2021, with sporadic outbreaks in Mainland China and the subsequent travel and quarantine restrictions impacting visitor arrivals.

I would like to acknowledge the Macau Government for acting decisively and effectively controlling the pandemic. As a socially responsible corporation, GEG continues to support the Macau Government’s epidemic preventive work. GEG’s team members overall COVID-19 vaccination rate has reached 94%.

Moving onto our full year performance, the Group’s Net Revenue, Adjusted EBITDA and NPAS all improved in 2021 relative to 2020. Our balance sheet also remained healthy and we are well positioned to navigate through the pandemic. Further, we announced a special dividend of $0.30 per share to be paid on or about 29 April 2022. This attests to our confidence in Macau, our financial strength and our future earnings potential.

We were encouraged by the performance over the recent Chinese New Year holiday. Even though visitor arrivals were less than anticipated due to travel restrictions, gaming revenue was solid, driven by premium mass, hotel occupancy was higher and retails sales were strong. This is evidence of strong pent up demand for tourism and leisure in Macau.

During this economically challenging period, GEG continued to invest in the advancement of Macau’s economy with our Cotai Phases 3 and 4 developments and renovating and upgrading our existing resort facilities where we intend to align the openings with the prevailing market conditions. We continue to pursue our project in Hengqin and are expanding our focus beyond Hengqin and Macau to potentially include opportunities within greater China including the rapidly developing Greater Bay Area.

In January 2022, the Macau Legislative Assembly passed its first reading of the "Legal Framework for the Exploitation of Games of Chance in Casino" and the Legislative Assembly Standing Committee is now going through a committee discussion. GEG fully supports the proposed legislation including that national and Macau security should be put as the top priority and the economic diversification and sustainable development should be a primary consideration.

Finally, I would again like to acknowledge and thank the health and emergency personnel who have worked so hard to ensure the safety of Macau. I would also like to thank our staff, management team and Board of Directors who voluntarily contributed to the various cost savings programs and for being so supportive of our Company during this period of time. Thank you.

Dr. Lui Che Woo

GBM, MBE, JP, LLD, DSSc, DBA

Chairman

|

Q4 & FULL YEAR 2021 RESULTS HIGHLIGHTS

GEG: Continues to be Impacted by COVID-19 and Travel Restrictions

Galaxy MacauTM: Continues to be Impacted by COVID-19 and Travel Restrictions

StarWorld Macau: Continues to be Impacted by COVID-19 and Travel Restrictions

Broadway Macau™: A Unique Family Friendly Resort, Strongly Supported by Macau SMEs

Balance Sheet: Healthy and Liquid Balance Sheet

Development Update: Continue Making Progress on Cotai Phases 3 & 4

|

Macau Market Overview

Basically for the whole of 2020 and 2021 Macau was impacted by COVID-19 and the associated travel restrictions. Based on DICJ reporting, Macau’s Gross Gaming Revenue (“GGR”) for the full year 2021 was $84.3 billion, up 44% year-on-year. GGR in Q4 2021 was $18.5 billion, down 13% year-on-year and up 2% quarter-on-quarter.

During Q4 2021, in tune with the broad range of changes in the regulatory environment we suspended VIP gaming operations, we will continue to monitor the situation.

In reviewing visitor arrivals, Macau arrivals have increased during 2021, admittedly off a low base. In January 2021, visitor arrivals were approximately 18,000 per day. In December 2021, this had increased to approximately 26,000 per day. Throughout the year arrival numbers varied to reflect sporadic outbreaks in COVID-19 and the subsequent travel and quarantine restrictions. But importantly we are moving in the right direction. Whilst we are encouraged by the increase in visitor arrivals we do acknowledge they still remain well below pre-pandemic levels. We look forward to further improvement in 2022 with possibly the progressive reinstatement of E-Visas and the opening of the Hong Kong border.

In 2021, visitor arrivals to Macau were 7.7 million, up 31% year-on-year, although the figure was 80% lower than 2019. Overnight visitors and same-day visitors increased 31% and 30% year-on-year respectively. The average length of stay for overnight visitors increased by 0.2 day to 1.6 days. Mainland visitor arrivals to Macau were 7.0 million, up 48% year-on-year. For Q4 2021, visitor arrivals to Macau were 2.0 million, up 4% year-on-year and up 7% quarter-on-quarter. Mainland visitor arrivals to Macau were 1.8 million, up 4% year-on-year and up 8% quarter-on-quarter.

Group Financial Results

Full Year 2021

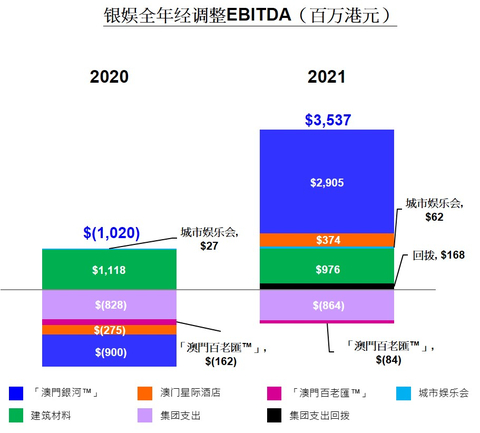

The Group posted Net Revenue of $19.7 billion, up 53% year-on-year. Adjusted EBITDA was $3.5 billion versus $(1.0) billion in 2020, which included a one-off expense reversal benefit of $0.2 billion in Q4 2021. Net profit attributable to shareholders was $1.3 billion versus $(4.0) billion in 2020. Galaxy Macau™’s Adjusted EBITDA was $2.9 billion versus $(0.9) billion in 2020. StarWorld Macau’s Adjusted EBITDA was $374 million versus $(275) million in 2020. Broadway Macau™’s Adjusted EBITDA was $(84) million versus $(162) million in 2020.

GEG played lucky in its gaming operation during 2021, which increased its Adjusted EBITDA by approximately $253 million. In addition, the Group experienced a one-off expense reversal benefit of $0.2 billion, normalized Adjusted EBITDA was $3.1 billion versus $(1.1) billion in 2020.

The Group’s total GGR on a management basis1 in 2021 was $17.3 billion, up 51% year-on-year. Mass GGR was $11.2 billion, up 83% year-on-year. VIP GGR was $5.5 billion, up 11% year-on-year. Electronic GGR was $642 million, up 35% year-on-year.

|

Summary Table of GEG Q4 and Full Year 2021 Adjusted EBITDA and Adjustments |

||||||||

|

in HK$'m |

Q4 |

Q3 |

Q4 |

YoY |

QoQ |

|

FY |

FY |

|

Adjusted EBITDA |

1,010 |

503 |

1,043 |

3% |

107% |

|

(1,020) |

3,537 |

|

Luck |

(59) |

(47) |

57 |

|

|

|

25 |

253 |

|

COVID insurance claim |

100 |

- |

- |

|

|

|

100 |

- |

|

Expense reversal benefit |

- |

- |

168 |

|

|

|

- |

168 |

|

Normalized Adjusted EBITDA |

969 |

550 |

818 |

-16% |

49% |

|

(1,145) |

3,116 |

|

Group Key Financial Data |

|

|

|

(HK$'m) |

2020 |

2021 |

|

Revenues: |

|

|

|

Net Gaming |

8,566 |

14,010 |

|

Non-gaming |

1,571 |

2,663 |

|

Construction Materials |

2,739 |

3,022 |

|

Total Net Revenue |

12,876 |

19,695 |

|

Adjusted EBITDA |

(1,020) |

3,537 |

|

|

|

|

|

Gaming Statistics2 |

|

|

|

(HK$'m) |

2020 |

2021 |

|

Rolling Chip Volume3 |

130,584 |

129,088 |

|

Win Rate % |

3.8% |

4.2% |

|

Win |

4,910 |

5,453 |

|

|

|

|

|

Mass Table Drop4 |

25,662 |

46,013 |

|

Win Rate % |

23.9% |

24.4% |

|

Win |

6,129 |

11,238 |

|

|

|

|

|

Electronic Gaming Volume |

14,131 |

17,627 |

|

Win Rate % |

3.4% |

3.6% |

|

Win |

477 |

642 |

|

|

|

|

|

Total GGR Win5 |

11,516 |

17,333 |

Balance Sheet and Dividend

The Group’s balance sheet remains liquid and healthy. As of 31 December 2021, cash and liquid investments were $33.4 billion and net cash was $27.0 billion. Total debt was $6.4 billion which primarily reflects our ongoing treasury yield management initiatives where interest income on cash holdings exceeds corresponding borrowing costs. Core debt remained minimal. This provides us with valuable flexibility in managing our ongoing operations and allows us to continue investing in our longer term development plans. We announced a special dividend of $0.30 per share to be paid on or about 29 April 2022. This attests to our confidence in Macau, our financial strength and our future earnings potential.

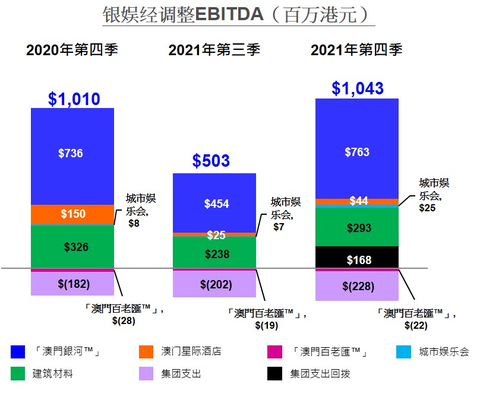

Q4 2021

During Q4 2021, the Group’s Net Revenue decreased 7% year-on-year and increased 11% quarter-on-quarter to $4.8 billion. Reported Adjusted EBITDA increased 3% year-on-year and increased 107% quarter-on-quarter to $1.0 billion, which included a one-off expense reversal benefit of $0.2 billion. Galaxy Macau™’s Adjusted EBITDA increased 4% year-on-year and increased 68% quarter-on-quarter to $763 million. StarWorld Macau’s Adjusted EBITDA decreased 71% year-on-year and increased 76% quarter-on-quarter to $44 million. Broadway Macau™’s Adjusted EBITDA was $(22) million versus $(19) million in Q3 2021 and $(28) million in Q4 2020.

During Q4 2021, GEG played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $57 million. Additionally, there was a one-off expense reversal benefit of $0.2 billion, Normalized Adjusted EBITDA decreased 16% year-on-year and increased 49% quarter-on-quarter to $818 million.

The Group’s total GGR on a management basis6 in Q4 2021 was $3.9 billion, down 16% year-on-year and up 6% quarter-on-quarter. Mass GGR was $3.0 billion, up 7% year-on-year, up 32% quarter-on-quarter. VIP GGR was $713 million, down 57% year-on-year and down 42% quarter-on-quarter. Electronic GGR was $159 million, down 10% year-on-year and up 6% quarter-on-quarter.

|

Group Key Financial Data |

|

|

|||

|

(HK$'m) |

|

|

|

|

|

|

Q4 2020 |

Q3 2021 |

Q4 2021 |

FY2020 |

FY2021 |

|

|

Revenues: |

|

|

|

||

|

Net Gaming |

3,651 |

2,913 |

3,256 |

8,566 |

14,010 |

|

Non-gaming |

646 |

608 |

666 |

1,571 |

2,663 |

|

Construction Materials |

806 |

761 |

830 |

2,739 |

3,022 |

|

Total Net Revenue |

5,103 |

4,282 |

4,752 |

12,876 |

19,695 |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

1,010 |

503 |

1,043 |

(1,020) |

3,537 |

|

|

|

|

|

|

|

|

Gaming Statistics7 |

|

|

|

|

|

|

(HK$'m) |

|

|

|

|

|

|

Q4 2020 |

Q3 2021 |

Q4 2021 |

FY2020 |

FY2021 |

|

|

Rolling Chip Volume8 |

43,910 |

27,827 |

17,318 |

130,584 |

129,088 |

|

Win Rate % |

3.8% |

4.4% |

4.1% |

3.8% |

4.2% |

|

Win |

1,648 |

1,234 |

713 |

4,910 |

5,453 |

|

|

|

|

|

|

|

|

Mass Table Drop9 |

12,037 |

10,099 |

11,449 |

25,662 |

46,013 |

|

Win Rate % |

23.4% |

22.8% |

26.4% |

23.9% |

24.4% |

|

Win |

2,817 |

2,301 |

3,027 |

6,129 |

11,238 |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

4,322 |

4,187 |

4,444 |

14,131 |

17,627 |

|

Win Rate % |

4.1% |

3.6% |

3.6% |

3.4% |

3.6% |

|

Win |

178 |

150 |

159 |

477 |

642 |

|

|

|

|

|

|

|

|

Total GGR Win10 |

4,643 |

3,685 |

3,899 |

11,516 |

17,333 |

Galaxy Macau™

Galaxy Macau™ is the primary contributor to Group revenue and earnings. In 2021, Net Revenue was up 71% year-on-year to $13.3 billion. Adjusted EBITDA was $2.9 billion versus $(0.9) billion in 2020. Galaxy Macau™ played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $207 million. Normalized 2021 Adjusted EBITDA was $2.7 billion versus $(1.0) billion in 2020, excluding the COVID-19 insurance claim and luck factor.

In Q4 2021, Galaxy Macau™’s Net Revenue was $3.2 billion, down 3% year-on-year and up 13% quarter-on-quarter. Adjusted EBITDA was $763 million, up 4% year-on-year and up 68% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 24% (Q4 2020: 22%). Galaxy Macau™ played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $25 million. Normalized Q4 2021 Adjusted EBITDA was $738 million. Note that there was a one-off COVID-19 insurance claim of $75 million and bad luck of $41 million in Q4 2020. Excluding the luck factor and insurance claim, normalized Q4 2020 Adjusted EBITDA was $702 million. Normalized Q4 2021 Adjusted EBITDA up 5% year-on-year and up 52% quarter-on-quarter.

The combined five hotels occupancy rate was 39% for Q4 2021 and 47% for the full year 2021.

|

Galaxy Macau™ Key Financial Data |

|||||

|

(HK$'m) |

|

|

|

|

|

|

Q4 2020 |

Q3 2021 |

Q4 2021 |

FY2020 |

FY2021 |

|

|

Revenues: |

|

|

|

||

|

Net Gaming |

2,731 |

2,279 |

2,599 |

6,398 |

10,832 |

|

Hotel / F&B / Others |

290 |

288 |

252 |

809 |

1,097 |

|

Mall |

297 |

269 |

363 |

572 |

1,347 |

|

Total Net Revenue |

3,318 |

2,836 |

3,214 |

7,779 |

13,276 |

|

Adjusted EBITDA |

736 |

454 |

763 |

(900) |

2,905 |

|

Adjusted EBITDA Margin |

22% |

16% |

24% |

NEG11 |

22% |

|

Gaming Statistics12 |

|

|

|

|

|

|

(HK$'m) |

Q4 2020 |

Q3 2021 |

Q4 2021 |

FY2020 |

FY2021 |

|

Rolling Chip Volume13 |

29,552 |

18,902 |

11,444 |

89,219 |

87,540 |

|

Win Rate % |

3.9% |

4.8% |

4.7% |

4.1% |

4.7% |

|

Win |

1,156 |

907 |

542 |

3,673 |

4,081 |

|

|

|

|

|

|

|

|

Mass Table Drop14 |

7,348 |

6,592 |

7,827 |

14,994 |

29,519 |

|

Win Rate % |

27.3% |

26.4% |

29.5% |

28.0% |

28.1% |

|

Win |

2,009 |

1,743 |

2,306 |

4,198 |

8,287 |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

3,064 |

2,947 |

3,109 |

8,755 |

12,736 |

|

Win Rate % |

5.0% |

4.1% |

4.2% |

4.2% |

4.1% |

|

Win |

153 |

122 |

130 |

368 |

528 |

|

|

|

|

|

|

|

|

Total GGR Win |

3,318 |

2,772 |

2,978 |

8,239 |

12,896 |

StarWorld Macau

In 2021, StarWorld Macau’s Net Revenue was up 47% year-on-year to $3.3 billion. Adjusted EBITDA was $374 million versus $(275) million in 2020. StarWorld Macau played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $46 million. Normalized 2021 Adjusted EBITDA was $328 million versus $(283) million in 2020, excluding the COVID-19 insurance claim and luck factor.

In Q4 2021, StarWorld Macau’s Net Revenue was $669 million, down 30% year-on-year and up 1% quarter-on-quarter. Adjusted EBITDA was $44 million, down 71% year-on-year and up 76% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 7% (Q4 2020: 16%). StarWorld Macau played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $32 million. Normalized Q4 2021 Adjusted EBITDA was $12 million. Note that there was a one-off COVID-10 insurance claim of $25 million and bad luck of $18 million in Q4 2020. Excluding the luck factor and insurance claim, normalized Q4 2020 Adjusted EBITDA of $143 million. Normalized Q4 2021 Adjusted EBITDA down 92% year-on-year and down 71% quarter-on-quarter.

Hotel occupancy was 55% for Q4 2021 and 65% for the full year 2021.

|

StarWorld Macau Key Financial Data |

|||||

|

(HK$’m) |

|

|

|||

|

Q4 2020 |

Q3 2021 |

Q4 2021 |

FY2020 |

FY2021 |

|

|

Revenues: |

|

|

|

||

|

Net Gaming |

914 |

627 |

632 |

2,119 |

3,116 |

|

Hotel / F&B / Others |

35 |

30 |

31 |

99 |

135 |

|

Mall |

6 |

7 |

6 |

19 |

27 |

|

Total Net Revenue |

955 |

664 |

669 |

2,237 |

3,278 |

|

Adjusted EBITDA |

150 |

25 |

44 |

(275) |

374 |

|

Adjusted EBITDA Margin |

16% |

4% |

7% |

NEG15 |

11% |

|

|

|

|

|

|

|

|

Gaming Statistics16 |

|

|

|

|

|

|

(HK$'m) |

|

|

|

|

|

|

Q4 2020 |

Q3 2021 |

Q4 2021 |

FY2020 |

FY2021 |

|

|

Rolling Chip Volume17 |

13,280 |

8,925 |

5,874 |

37,434 |

40,608 |

|

Win Rate % |

3.6% |

3.7% |

2.9% |

3.0% |

3.3% |

|

Win |

481 |

327 |

171 |

1,140 |

1,331 |

|

|

|

|

|

|

|

|

Mass Table Drop18 |

3,957 |

2,825 |

2,798 |

8,474 |

13,477 |

|

Win Rate % |

16.9% |

16.0% |

20.2% |

18.1% |

18.2% |

|

Win |

668 |

453 |

565 |

1,535 |

2,447 |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

584 |

585 |

534 |

2,099 |

2,303 |

|

Win Rate % |

2.1% |

2.4% |

2.2% |

2.2% |

2.6% |

|

Win |

11 |

14 |

12 |

45 |

60 |

|

|

|

|

|

|

|

|

Total GGR Win |

1,160 |

794 |

748 |

2,720 |

3,838 |

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs. In 2021, Broadway Macau™’s Net Revenue was $57 million, down 39% year-on-year. Adjusted EBITDA was $(84) million versus $(162) million in 2020. There was no luck impact on Broadway Macau™’s Adjusted EBITDA in 2021.

In Q4 2021, Broadway Macau™’s Net Revenue was $14 million, down 13% year-on-year, flat quarter-on-quarter. Adjusted EBITDA was $(22) million, versus $(28) million in prior year and $(19) million in Q3 2021. There was no luck impact on Broadway Macau™’s Adjusted EBITDA in Q4 2021.

Hotel occupancy was 3% for Q4 2021 and 6% for full year 2021, this was due to the fact that the hotel’s operations were suspended for the majority of the year.

|

Broadway Macau™ Key Financial Data |

|||||

|

(HK$'m) |

|

|

|||

|

Q4 2020 |

Q3 2021 |

Q4 2021 |

FY2020 |

FY2021 |

|

|

Revenues: |

|

|

|

|

|

|

Net Gaming |

0 |

0 |

0 |

22 |

0 |

|

Hotel / F&B / Others |

10 |

8 |

8 |

49 |

32 |

|

Mall |

6 |

6 |

6 |

23 |

25 |

|

Total Net Revenue |

16 |

14 |

14 |

94 |

57 |

|

Adjusted EBITDA |

(28) |

(19) |

(22) |

(162) |

(84) |

|

Adjusted EBITDA Margin |

NEG19 |

NEG19 |

NEG19 |

NEG19 |

NEG19 |

|

|

|

|

|

|

|

|

Gaming Statistics20 |

|

|

|

|

|

|

(HK$'m) |

|

|

|

|

|

|

Q4 2020 |

Q3 2021 |

Q4 2021 |

FY2020 |

FY2021 |

|

|

Mass Table Drop21 |

NIL* |

NIL* |

NIL* |

114 |

NIL* |

|

Win Rate % |

NIL* |

NIL* |

NIL* |

17.9% |

NIL* |

|

Win |

NIL* |

NIL* |

NIL* |

20 |

NIL* |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

7 |

6 |

3 |

337 |

25 |

|

Win Rate % |

1.5% |

5.6% |

0.7% |

2.1% |

4.1% |

|

Win |

0 |

0 |

0 |

7 |

1 |

|

|

|

|

|

|

|

|

Total GGR Win |

0 |

0 |

0 |

27 |

1 |

* NIL represents tables not opened during the period.

City Clubs

In 2021, City Clubs contributed $62 million of Adjusted EBITDA, up 130% year-on-year. In Q4 2021 Adjusted EBITDA was $25 million, up 213% year-on-year, up 257% quarter-on-quarter.

|

City Clubs Key Financial Data |

|||||

|

(HK$'m) |

Q4 2020 |

Q3 2021 |

Q4 2021 |

FY2020 |

FY2021 |

|

Adjusted EBITDA |

8 |

7 |

25 |

27 |

62 |

|

|

|

|

|

|

|

|

Gaming Statistics22 |

|

|

|

|

|

|

(HK$'m) |

|

|

|

|

|

|

Q4 2020 |

Q3 2021 |

Q4 2021 |

FY2020 |

FY2021 |

|

|

Rolling Chip Volume23 |

1,078 |

NIL* |

NIL* |

3,931 |

940 |

|

Win Rate % |

1.1% |

NIL* |

NIL* |

2.5% |

4.4% |

|

Win |

11 |

NIL* |

NIL* |

97 |

41 |

|

|

|

|

|

|

|

|

Mass Table Drop24 |

732 |

682 |

824 |

2,080 |

3,017 |

|

Win Rate % |

19.2% |

15.4% |

18.9% |

18.1% |

16.7% |

|

Win |

140 |

105 |

156 |

376 |

504 |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

667 |

649 |

798 |

2,940 |

2,563 |

|

Win Rate % |

1.9% |

2.1% |

2.1% |

1.9% |

2.1% |

|

Win |

14 |

14 |

17 |

57 |

53 |

|

|

|

|

|

|

|

|

Total GGR Win |

165 |

119 |

173 |

530 |

598 |

* NIL represents tables not opened during the period.

Construction Materials Division

Construction Materials delivered a solid performance in the Mainland and Hong Kong markets. In 2021, Adjusted EBITDA was $976 million, down 13% year-on-year. In Q4 2021 Adjusted EBITDA was $293 million, down 10% year-on-year and up 23% quarter-on-quarter.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests.

Cotai – The Next Chapter

GEG is uniquely positioned for long term growth. Phase 3 is effectively completed and we plan to align the opening with improving market conditions. We are now firmly focused on the development of Phase 4, which is already well under way. We see the premium market evolving with this segment preferring higher quality and more spacious rooms. Phases 3 & 4 combined will have approximately 3,000 high end and family rooms and villas, 400,000 square feet of MICE space, a 500,000 square feet 16,000-seat multi-purpose arena, F&B, retail and casinos, among others.

The Group was pleased to announce in March 2021 the signing of a collaboration agreement with Accor to introduce the renowned Raffles brand to Macau. We look forward to welcoming the iconic Raffles at Galaxy Macau through an exclusive 450 all-suite tower and will align the opening with prevailing market conditions.

We intend to follow this with the opening of the GICC and Andaz Macau in anticipation of the recovery of the MICE and entertainment markets. We continue to proceed with the construction of Cotai Phase 4, our next generation integrated resort, which will complete our ecosystem in Cotai. As you can see, we remain highly confident about the future of Macau where Cotai Phases 3 and 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

Future Development Opportunities

We continue to pursue our project in Hengqin and are expanding our focus beyond Hengqin and Macau to potentially include opportunities within Mainland China, with a particular focus on the rapidly developing Greater Bay Area. The Master Plan of the Development of the Guangdong-Macau Intensive Cooperation Zone in Hengqin was unveiled in early September 2021. The management committee of the cooperation zone will be jointly established by Guangdong and Macau and co-chaired by the Governor of Guangdong Province and the Chief Executive of Macau. The long-term goal of the cooperation zone is to establish a better collaboration mechanism between Hengqin and Macau by 2035, and basically achieve moderate economic diversification in Macau.

International

Given the pandemic’s economic impact within the region, we have decided not to participate in the recent round of bidding. Shorter term we have reduced our presence in Japan, however, we continue to believe that Japan has significant longer term potential and we will continue to monitor the development of the market and the licensing process.

Selected Major Awards for 2021

|

Award |

Presenter |

|

GEG |

|

|

2021 Asian Gaming Power 50 List No.1 - Mr. Francis Lui |

Inside Asian Gaming |

|

Casino Operator of the Year

Charitable Community Award |

International Gaming Awards 2021 |

|

ESG Recognitions Ceremony 2021 - ESG Care Label 2021-2022 |

SocietyNext Foundation, UNESCO Hong Kong Association Glocal Peace Centre and Rotary Action Group for Peace Hong Kong & Macao Chapter |

|

ISO 45001:2018 Occupational Health and Safety Management Certification |

British Standards Institution |

|

Galaxy MacauTM |

|

|

2021 Particularly Pleasant Luxury Hotel - The Ritz-Carlton, Macau - Banyan Tree Macau

2021 Particularly Pleasant Top Class Comfort Hotel - Hotel Okura Macau |

Michelin Guide Hong Kong and Macau 2021 |

|

2021 Forbes Travel Guide Five-star Hotel - The Ritz-Carlton, Macau - Banyan Tree Macau

2021 Forbes Travel Guide Five-star Spa - The Ritz-Carlton Spa, Macau - Banyan Tree Spa Macau

2021 Forbes Travel Guide - Health Security VERIFIED™ - The Ritz-Carlton, Macau - Banyan Tree Macau - Hotel Okura Macau - Galaxy Hotel |

Forbes Travel Guide |

|

Energy Saving Concept Award (Hotel Group)

Hotel Group B (Excellence Award) |

Macau Energy Saving Activity 2020 |

|

Macao Green Hotel Awards - Silver Award - Galaxy Hotel |

Environmental Protection Bureau (DSPA) |

|

Macau’s Best Resort Spa 2021 – Banyan Tree Macau |

World Spa Awards |

|

Silver Certification for Environmental Design - Galaxy MacauTM Phase 3 |

EarthCheck |

|

StarWorld Macau |

|

|

Top Class Comfort Hotel |

Michelin Guide Hong Kong and Macau 2021 |

|

Broadway MacauTM |

|

|

Hotel Group B (Excellence Award) |

Macau Energy Saving Activity 2020 |

|

Construction Materials Division |

|

|

Hong Kong Green Organization Certification “Wastewi$e” Certificate - Excellence Level |

Environmental Campaign Committee |

|

BOCHK Corporate Environmental Leadership Awards 2020 - EcoPartner 3 Years+ EcoPioneer |

Bank of China (Hong Kong) and Federation of Hong Kong Industries |

|

The 19th Hong Kong Occupational Safety & Health Award - Safety Performance Award (Other Industries) - Outstanding

The 19th Hong Kong Occupational Safety & Health Award - Safety Management System Award (Other Industries) - Merit

The 19th Hong Kong Occupational Safety & Health Award - Safety Management System Award - Best Workplace Infection Control Measures Award (Other Industries) - Merit |

Occupational Safety and Health Council

|

Outlook

As we enter the third year of the pandemic, we have focused on turning this crisis into an opportunity. We have become better at adapting to the ‘new normal’ through creative thinking and constantly striving for improvement. GEG team members have been working hard to do more with less and have been very supportive of the various company initiatives. As a socially responsible corporation, GEG continues to support the Macau Government’s epidemic preventive work and the overall COVID-19 vaccination rate for GEG’s team members has now reached 94%. We believe that the reoccurrence of COVID-19 cases will continue to impact Macau for the immediate future, which in turn could impact our financial results going forward. However, in the medium to longer term we continue to have great confidence in Macau and we are well positioned for future growth with our Phases 3 & 4 developments.

Mainland China and Macau continue to experience social distancing measures and travel restrictions which have been progressively easing. As visitor arrivals have increased through 2021, revenue has also improved, we hope this trend can continue. We look forward to the reinstatement of the E-visas and group travel in Mainland and the border reopening of Hong Kong and Macau which will further increase visitor arrivals and associated revenue. Whilst we are encouraged by the increase in visitor arrivals we do acknowledge they still remain well below pre-pandemic levels.

Macau concessionaires are working with the MGTO to actively promote Macau as a safe tourism destination and has hosted a series of roadshows and exhibitions in a numbers of Mainland cities. We will continue to actively support this important government initiative. In the medium to longer term, we have great confidence in the future of Macau. But in the shorter term, the reoccurrence of COVID-19 outbreaks may continue to impact visitor arrivals and associated revenues.

Given the continued contraction in the VIP business, we have been reallocating our resources and marketing efforts to the higher margin mass-oriented tourists whom appreciate Galaxy’s extensive resort offerings, such as a wide range of hotel selections, extensive F&B choices, wide selection of retails and non-gaming amenities such as the resort deck.

We welcome the amendment of Gaming Law and it has been positively received by the community.

Given our track record of introducing innovative non-gaming elements into our resorts, our strong operational history, significant investment into Macau’s economy and our substantial CSR efforts including supporting SME’s, we are well positioned to compete for one of Macau’s forthcoming gaming concessions. We look forward for the approval from the Legislative Assembly and the completion of the concession bidding process.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award winning premium property.

The Group has the largest undeveloped landbank of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will double to more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG is also progressing plans for its Hengqin project and we are also expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM including Japan.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates. For more information about the Group, please visit www.galaxyentertainment.com

1 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the Group level the gaming statistics include Company owned resorts plus City Clubs.

2 Gaming statistics are presented before deducting commission and incentives.

3 Reflects junket rolling chip volume only.

4 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

6 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the group level the gaming statistics include Company owned resorts plus City Clubs.

7 Gaming statistics are presented before deducting commission and incentives.

8 Reflects junket rolling chip volume only.

9 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

10 Total GGR win includes gaming win from City Clubs.

11 NEG represents negative margin.

12 Gaming statistics are presented before deducting commission and incentives.

13 Reflects junket rolling chip volume only.

14 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

15 NEG represents negative margin.

16 Gaming statistics are presented before deducting commission and incentives.

17 Reflects junket rolling chip volume only.

18 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

19 NEG represents negative margin.

20 Gaming statistics are presented before deducting commission and incentives.

21 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

22 Gaming statistics are presented before deducting commission and incentives.

23 Reflects junket rolling chip volume only.

24 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.