HONG KONG--(BUSINESS WIRE)--Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three-month period ended 30 September 2021. (All amounts are expressed in Hong Kong dollars unless otherwise stated)

LETTER FROM THE CHAIRMAN OF GALAXY ENTERTAINMENT GROUP

I wish to take this opportunity to update you on the status of Macau and the performance of GEG in Q3 2021. During Q3 both Mainland China and Macau experienced highly publicized periodic outbreaks of COVID-19. As a result, selected travel restrictions were implemented during these periods which severely impacted Macau visitation and revenue. It is pleasing to note that once travel restrictions were lifted visitor arrivals quickly rebounded. This gives us confidence that there is pent up demand for leisure, tourism, travel within Mainland China. We would like to again acknowledge Macau Government for acting decisively to contain the most recent outbreak of COVID-19 including completing the mass testing of Macau’s residents. GEG has been very supportive of the Government vaccination program by hosting both testing and vaccination facilities within our resorts. We are pleased to report that GEG has achieved a 92% vaccination level for team members and we are working hard to achieve 95% in the near future.

Importantly, during the quarter the Macau Government launched a 45-day consultation program on revising the Macau gaming law. The key points that were listed within the consultation paper were not a surprise to those who closely follow Macau. We believe that the suggested proposals if implemented would improve the regulatory oversight of the industry, increase the sectors transparency and secure the long term viability of Macau’s most important economic pillar.

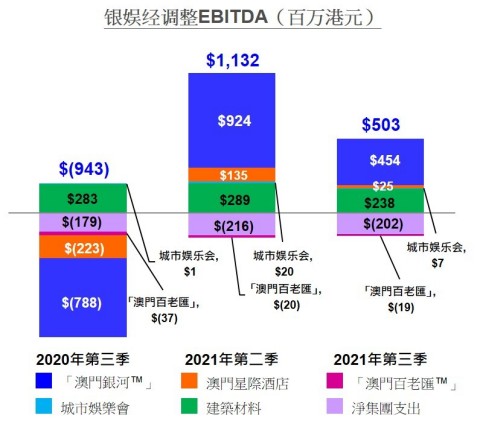

Moving onto our Q3 2021 performance, Group Net Revenue was $4.3 billion, Vs $1.6 billion in Q3 2020 and $5.6 billion in Q2 2021. Group Adjusted EBITDA was $503 million, Vs $(943) million in Q3 2020 and $1.1 billion in Q2 2021. Further, our performance was supported by our continued vigilant focus on our cost control measures across the Group. We also continue to improve our properties including enhancing our retail experience by adding more world class brands, among others, where retail delivered another solid performance. Our balance sheet remains liquid and healthy. As of 30 September 2021, cash and liquid investments were $38.4 billion and net cash was $27.8 billion. Total debt was $10.6 billion at 30 September 2021, including $10.2 billion associated with our treasury yield enhancement program and $0.4 billion of core debt. This provides us with valuable flexibility in managing operations and supporting our ongoing development initiatives.

Moving onto our development update, we continue to invest into Cotai Phases 3 and 4, which will support the ongoing economic development and industry diversification of Macau including the MICE market, particularly following the opening of the Galaxy International Convention Center (“GICC”). Phase 3 includes Raffles at Galaxy Macau which features an approximate 450 all-suite tower and we wish to align the opening with prevailing market conditions in 2022. We intend to follow this with the opening of the GICC and Andaz Macau in anticipation of the recovery of the MICE and entertainment markets. We are also continuing to proceed with the construction of Cotai Phase 4, our next generation integrated resort, which will complete our ecosystem in Cotai. As you can see, we remain highly confident about the future of Macau where Cotai Phases 3 and 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

We are pleased that the Central Government recently in September 2021 unveiled the Master Plan for the Development of the Guangdong-Macau Intensive Cooperation Zone in Hengqin. We believe that the gaming and tourism industry will greatly benefit from this master plan which confirms strong support from the Central Government for Macau and its long term growth potential as well as the Greater Bay Area. We believe that the future relaxation of immigration between Macau and Hengqin will stimulate further economic activity. We continue to pursue our project in Hengqin and are expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area. We, along with Monte-Carlo SBM from the Principality of Monaco still remain interested in the long term prospects of Japan and are confident that they will successfully navigate through the COVID-19 pandemic.

Additionally, during Q3, GEG continued its social responsibility program by subscribing RMB100 million to the Bank of China’s first Biodiversity Themed Green Bond. Our investment commitment continues to demonstrate GEG’s support of Macau’s economic diversification and the development of Macau’s financial market.

Furthermore, we are particularly pleased with the significant improvement of infrastructure in Q3. On 8 September 2021, the Qingmao Checkpoint commenced operation which has the capacity to process up to an additional 200,000 visitor crossings per day via 50 inbound and 50 outbound automated inspection channels. Again, this represents yet another positive signal for the long term support of Macau.

Finally, I would again like to acknowledge and thank the Government of Macau, the health and emergency personnel who have worked so hard to ensure the safety of Macau, especially those volunteers whom supported the mandatory COVID testing programs during the quarter.

I would also like to thank our staff, management team and Board of Directors who voluntarily contributed to our various cost savings programs and for being so supportive of our Company during this period of time. Thank you!

Dr. Lui Che Woo

GBM, MBE, JP, LLD, DSSc, DBA

Chairman

|

Q3 2021 RESULTS HIGHLIGHTS

GEG: Continues to be Impacted by COVID and Travel Restrictions

Galaxy Macau™: Continues to be Impacted by COVID and Travel Restrictions

StarWorld Macau: Continues to be Impacted by COVID and Travel Restrictions

Broadway Macau™: A Unique Family Friendly Resort, Strongly Supported by Macau SMEs

Balance Sheet: Maintain a Healthy and Liquid Balance Sheet

Development Update: Continue Making Progress on Cotai Phases 3 & 4

|

Market Overview

During Q3 2021, Macau successfully completed COVID testing of all residents twice due to imported cases. The vaccination program continues to roll out and as of 5 November 2021, the overall vaccination rate was approximately 70%. The Macau Government stated that the city needs at least 80% vaccination rate to start discussing expanding the ability to visit Macau with the Central Government.

In early August and late September 2021, there were two imported cases of COVID resulting in tighter border controls between Macau and Mainland. This impacted both visitation and gross gaming revenue (“GGR”) in Q3. In Q3 2021, visitor arrivals to Macau were 1.8 million, versus 750,204 in Q3 2020 and 2.2 million in Q2 2021. Mainland visitor arrivals to Macau were 1.7 million, versus 679,773 in Q3 2020 and 2 million in Q2 2021. Based on DICJ reporting, Macau’s GGR for Q3 2021 was $18.2 billion, down 26% quarter-on-quarter or 27% of pre-pandemic level.

Group Financial Results

In Q3 2021, the Group posted Net Revenue of $4.3 billion, up 176% year-on-year and down 23% quarter-on-quarter. Adjusted EBITDA was $503 million Vs $(943) million in Q3 2020 and $1.1 billion in Q2 2021. Galaxy Macau™’s Adjusted EBITDA was $454 million Vs $(788) million in Q3 2020 and $924 million in Q2 2021. StarWorld Macau’s Adjusted EBITDA was $25 million Vs $(223) million in Q3 2020 and $135 million in Q2 2021. Broadway Macau™’s Adjusted EBITDA was $(19) million Vs $(37) million in Q3 2020 and $(20) million in Q2 2021. Latest twelve months Adjusted EBITDA was $3.5 billion, up 73% year-on-year and up 70% quarter-on-quarter. Retail also delivered another solid performance as we continue to enhance our mall by adding more world class luxury brands.

During Q3 2021, GEG played unlucky in its gaming operations which decreased Adjusted EBITDA by approximately $47 million. Normalized Q3 2021 Adjusted EBITDA was $550 million, Vs $(940) million in Q3 2020 and $1.1 billion in Q2 2021.

The Group’s total GGR on a management basis1 in Q3 2021 was $3.7 billion, up 325% year-on-year and down 26% quarter-on-quarter. Mass GGR was $2.3 billion, up 541% year-on-year and down 25% quarter-on-quarter. VIP GGR was $1.2 billion, up 162% year-on-year and down 27% quarter-on-quarter. Electronic GGR was $150 million, up 318% year-on-year and down 26% quarter-on-quarter.

|

Group Key Financial Data |

||||||

|

(HK$'m) |

Q3 2020 |

|

Q2 2021 |

|

Q3 2021 |

|

|

Revenues: |

|

|

|

|

|

|

|

Net Gaming |

593 |

|

3,984 |

|

2,913 |

|

|

Non-gaming |

246 |

|

791 |

|

608 |

|

|

Construction Materials |

711 |

|

790 |

|

761 |

|

|

Total Net Revenue |

1,550 |

|

5,565 |

|

4,282 |

|

|

Adjusted EBITDA |

(943) |

|

1,132 |

|

503 |

|

|

|

|

|

|

|

|

|

|

Gaming Statistics2 |

||||||

|

(HK$'m) |

|

|

|

|

|

|

|

Q3 2020 |

|

Q2 2021 |

|

Q3 2021 |

||

|

Rolling Chip Volume3 |

11,801 |

|

36,708 |

|

27,827 |

|

|

Win Rate % |

4.0% |

|

4.6% |

|

4.4% |

|

|

Win |

472 |

|

1,694 |

|

1,234 |

|

|

|

|

|

|

|

||

|

Mass Table Drop4 |

1,654 |

|

12,880 |

|

10,099 |

|

|

Win Rate % |

21.7% |

|

23.8% |

|

22.8% |

|

|

Win |

359 |

|

3,061 |

|

2,301 |

|

|

|

|

|

|

|

||

|

Electronic Gaming Volume |

1,324 |

|

4,801 |

|

4,187 |

|

|

Win Rate % |

2.7% |

|

4.2% |

|

3.6% |

|

|

Win |

36 |

|

203 |

|

150 |

|

|

|

|

|

|

|

|

|

|

Total GGR Win5 |

867 |

|

4,958 |

|

3,685 |

|

Balance Sheet

The Group’s balance sheet remains liquid and healthy. As of 30 September 2021, cash and liquid investments were $38.4 billion and net cash was $27.8 billion. Total debt was $10.6 billion which primarily reflects our ongoing treasury yield management initiatives where interest income on cash holdings exceeds corresponding borrowing costs. Core debt remained minimal.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to the Group’s revenue and earnings. Net Revenue in Q3 2021 was $2.8 billion, up 353% year-on-year and down 26% quarter-on-quarter. Adjusted EBITDA was $454 million Vs $(788) million in Q3 2020 and $924 million in Q2 2021. Retail delivered another solid performance as we continue to enhance our mall by adding more world class luxury brands.

Galaxy Macau™ played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $31 million in Q3 2021. Normalized Q3 2021 Adjusted EBITDA was $485 million, Vs $(787) million in Q3 2020 and $838 million in Q2 2021.

Hotel occupancy for Q3 2021 across the five hotels was 45%.

|

Galaxy Macau™ Key Financial Data |

||||||

|

(HK$'m) |

|

|

|

|||

|

Q3 2020 |

|

Q2 2021 |

|

Q3 2021 |

||

|

Revenues: |

|

|

|

|

|

|

|

Net Gaming |

407 |

|

3,079 |

|

2,279 |

|

|

Hotel / F&B / Others |

146 |

|

307 |

|

288 |

|

|

Mall |

73 |

|

423 |

|

269 |

|

|

Total Net Revenue |

626 |

|

3,809 |

|

2,836 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

(788) |

|

924 |

|

454 |

|

|

Adjusted EBITDA Margin |

NEG6 |

|

24% |

|

16% |

|

|

|

|

|

|

|||

|

Gaming Statistics7 |

||||||

|

(HK$'m) |

|

|

|

|||

|

Q3 2020 |

|

Q2 2021 |

|

Q3 2021 |

||

|

Rolling Chip Volume8 |

6,785 |

|

24,582 |

|

18,902 |

|

|

Win Rate % |

4.6% |

|

5.4% |

|

4.8% |

|

|

Win |

309 |

|

1,331 |

|

907 |

|

|

|

|

|

|

|

||

|

Mass Table Drop9 |

860 |

|

7,972 |

|

6,592 |

|

|

Win Rate % |

25.9% |

|

27.8% |

|

26.4% |

|

|

Win |

223 |

|

2,219 |

|

1,743 |

|

|

|

|

|

|

|

||

|

Electronic Gaming Volume |

746 |

|

3,513 |

|

2,947 |

|

|

Win Rate % |

3.2% |

|

4.9% |

|

4.1% |

|

|

Win |

23 |

|

174 |

|

122 |

|

|

|

|

|

|

|

|

|

|

Total GGR Win |

555 |

|

3,724 |

|

2,772 |

|

StarWorld Macau

StarWorld Macau’s Net Revenue in Q3 2021 was $664 million, up 234% year-on-year and down 29% quarter-on-quarter. Adjusted EBITDA was $25 million Vs $(223) million in Q3 2020 and $135 million in Q2 2021.

StarWorld Macau played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $16 million in Q3 2021. Normalized Q3 2021 Adjusted EBITDA was $41 million, Vs $(221) million in Q3 2020 and $147 million in Q2 2021.

Hotel occupancy was 56% for Q3 2021.

|

StarWorld Macau Key Financial Data |

||||||

|

(HK$'m) |

|

|

|

|||

|

Q3 2020 |

|

Q2 2021 |

|

Q3 2021 |

||

|

Revenues: |

|

|

|

|

|

|

|

Net Gaming |

184 |

|

885 |

|

627 |

|

|

Hotel / F&B / Others |

10 |

|

40 |

|

30 |

|

|

Mall |

5 |

|

7 |

|

7 |

|

|

Total Net Revenue |

199 |

|

932 |

|

664 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

(223) |

|

135 |

|

25 |

|

|

Adjusted EBITDA Margin |

NEG10 |

|

14% |

|

4% |

|

|

|

|

|

|

|||

|

Gaming Statistics11 |

||||||

|

(HK$'m) |

|

|

|

|||

|

Q3 2020 |

|

Q2 2021 |

|

Q3 2021 |

||

|

Rolling Chip Volume12 |

4,429 |

|

12,126 |

|

8,925 |

|

|

Win Rate % |

3.3% |

|

3.0% |

|

3.7% |

|

|

Win |

148 |

|

363 |

|

327 |

|

|

|

|

|

|

|

||

|

Mass Table Drop13 |

619 |

|

4,064 |

|

2,825 |

|

|

Win Rate % |

16.9% |

|

17.3% |

|

16.0% |

|

|

Win |

105 |

|

702 |

|

453 |

|

|

|

|

|

|

|

||

|

Electronic Gaming Volume |

155 |

|

664 |

|

585 |

|

|

Win Rate % |

2.3% |

|

2.5% |

|

2.4% |

|

|

Win |

4 |

|

16 |

|

14 |

|

|

|

|

|

|

|

|

|

|

Total GGR Win |

257 |

|

1,081 |

|

794 |

|

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs. The property’s Net Revenue in Q3 2021 was $14 million, Vs $13 million in Q3 2020 and $14 million in Q2 2021. Adjusted EBITDA was $(19) million Vs $(37) million in Q3 2020 and $(20) million in Q2 2021.

There was no luck impact on Broadway Macau™’s Adjusted EBITDA in Q3 2021.

Hotel operation was suspended during Q3 2021.

|

Broadway Macau™ Key Financial Data |

||||||

|

(HK$'m) |

|

|

|

|||

|

Q3 2020 |

|

Q2 2021 |

|

Q3 2021 |

||

|

Revenues: |

|

|

|

|

|

|

|

Net Gaming |

1 |

|

0 |

|

0 |

|

|

Hotel / F&B / Others |

6 |

|

7 |

|

8 |

|

|

Mall |

6 |

|

7 |

|

6 |

|

|

Total Net Revenue |

13 |

|

14 |

|

14 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

(37) |

|

(20) |

|

(19) |

|

|

Adjusted EBITDA Margin |

NEG14 |

|

NEG14 |

|

NEG14 |

|

|

|

|

|

|

|||

|

Gaming Statistics15 |

||||||

|

(HK$'m) |

|

|

|

|||

|

Q3 2020 |

|

Q2 2021 |

|

Q3 2021 |

||

|

Mass Table Drop16 |

NIL* |

|

NIL* |

|

NIL* |

|

|

Win Rate % |

NIL* |

|

NIL* |

|

NIL* |

|

|

Win |

NIL* |

|

NIL* |

|

NIL* |

|

|

|

|

|

|

|

||

|

Electronic Gaming Volume |

36 |

|

3 |

|

6 |

|

|

Win Rate % |

2.4% |

|

6.6% |

|

5.6% |

|

|

Win |

1 |

|

1 |

|

0 |

|

|

|

|

|

|

|

|

|

|

Total GGR Win |

1 |

|

1 |

|

0 |

|

|

* NIL represents tables not opened during the period. |

||||||

City Clubs

In Q3 2021, City Clubs contributed $7 million of Adjusted EBITDA to the Group’s earnings, up 600% year-on-year and down 65% quarter-on-quarter.

|

City Clubs Key Financial Data |

||||||

|

(HK$'m) |

|

|

|

|||

|

Q3 2020 |

|

Q2 2021 |

|

Q3 2021 |

||

|

Adjusted EBITDA |

1 |

|

20 |

|

7 |

|

|

|

|

|

|

|||

|

Gaming Statistics17 |

||||||

|

(HK$'m) |

|

|

|

|||

|

Q3 2020 |

|

Q2 2021 |

|

Q3 2021 |

||

|

Rolling Chip Volume18 |

587 |

|

NIL* |

|

NIL* |

|

|

Win Rate % |

2.4% |

|

NIL* |

|

NIL* |

|

|

Win |

15 |

|

NIL* |

|

NIL* |

|

|

|

|

|

|

|

||

|

Mass Table Drop19 |

175 |

|

844 |

|

682 |

|

|

Win Rate % |

17.8% |

|

16.7% |

|

15.4% |

|

|

Win |

31 |

|

140 |

|

105 |

|

|

|

|

|

|

|

||

|

Electronic Gaming Volume |

387 |

|

621 |

|

649 |

|

|

Win Rate % |

2.0% |

|

1.9% |

|

2.1% |

|

|

Win |

8 |

|

12 |

|

14 |

|

|

|

|

|

|

|

|

|

|

Total GGR Win |

54 |

|

152 |

|

119 |

|

|

* NIL represents tables not opened during the period. |

||||||

Construction Materials Division

The Construction Materials Division contributed Adjusted EBITDA of $238 million in Q3 2021, down 16% year-on-year and down 18% quarter-on-quarter as challenges in Yunnan partially offset a solid performance in Hong Kong.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests.

Cotai – The Next Chapter

GEG is uniquely positioned for long term growth. We are proceeding with the development of Phases 3 & 4 and continue to review and refine plans to ensure a world-class optimal development. We see the premium market evolving with this segment preferring higher quality and more spacious rooms. Phases 3 & 4 combined will have approximately 3,000 high end and family rooms and villas, 400,000 square feet of MICE space, a 500,000 square feet 16,000-seat multi-purpose arena, F&B, retail and casinos, among others. We will try to maintain our development targets, however due to COVID-19, development timelines may be impacted.

The Group was pleased to announce in March 2021 the signing of a collaboration agreement with Accor to introduce the renowned Raffles brand to Macau. We look forward to welcoming the iconic Raffles at Galaxy Macau through an exclusive 450 all-suite tower and will align the opening with prevailing market conditions in 2022.

We intend to follow this with the opening of the GICC and Andaz Macau in anticipation of the recovery of the MICE and entertainment markets. And, finally, we continue to proceed with the construction of Cotai Phase 4, our next generation integrated resort, which will complete our ecosystem in Cotai. As you can see, we remain highly confident about the future of Macau where Cotai Phases 3 and 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

Greater Bay Area / Hengqin

We continue to pursue our project in Hengqin and are expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area. The Master Plan of the Development of the Guangdong-Macau Intensive Cooperation Zone in Hengqin was unveiled in early September 2021. The management committee of the cooperation zone will be jointly established by Guangdong and Macau and co-chaired by the governor of Guangdong Province and the Chief Executive of Macau. The long-term goal of the cooperation zone is to establish a better collaboration mechanism between Hengqin and Macau by 2035, and basically achieve moderate economic diversification in Macau.

International

Our Japan based team continues with our Japan development efforts even as they deal with the COVID-19 crisis. We view Japan as a long term growth opportunity that will complement our Macau operations and our other international expansion ambitions. GEG, together with Monte-Carlo SBM from the Principality of Monaco and our Japanese partners, remain interested in bringing our brand of World Class IRs to Japan given the right circumstances.

Selected Major Awards for Q3 2021

|

Award |

Presenter |

|

GEG |

|

|

Casino Operator of the Year Charitable Community Award |

International Gaming Awards 2021 |

|

Gold Award for Culture (Traditional Performance and Visual Arts) |

Pacific Asia Travel Association |

|

Certificate of Excellence |

Hong Kong Investor Relations Association |

|

Construction Materials Division |

|

|

BOCHK Corporate Environmental Leadership Awards 2020 – EcoPartner 3 Years+ EcoPioneer |

Bank of China (Hong Kong) and Federation of Hong Kong Industries |

|

Construction Industry Volunteer Award Scheme 2021 - Merit Award for Participation |

Construction Industry Sports and Volunteering Programme |

Outlook

Macau continues to be impacted by periodic COVID outbreaks and subsequent travel restrictions, this was most recently experienced during Golden Week. The Macau Government has continued to demonstrate their prompt and decisive action in being able to effectively contain COVID-19 hot spots and test the entire population of Macau within 3 days. We greatly appreciated their efforts and thank all of the health and emergency personnel and volunteers. Macau’s public health and safety as well as economic and social stability remains the Government’s highest priority.

During this extended down period of low visitor arrivals and subsequent low hotel occupancy, we have taken this opportunity to renovate and upgrade our existing properties. We are well positioned to capture high value customers when the market returns. We are driving every segment of our business by enhancing operational efficiencies and exercising prudent cost control especially under the current market conditions. We continue to support the economic development of Macau through our Cotai Phases 3 & 4 projects which positions us strongly for the future growth in leisure and tourism demand from Mainland China.

Further, our GICC facilities will support the Government initiative to diversify Macau’s economy and its vision to become a World Centre of Tourism and Leisure by expanding the MICE market which attract old and new visitors from all over the world by offering a wide variety of conventions, exhibitions, entertainment events and concerts, as well as by promoting auctions from antiques to traditional and modern arts to create business opportunities and attract the appreciative class. This will also provide additional alternative career development opportunities for local Macanese in areas such as event management, catering and entertainment, among others. We also continue to provide ongoing career development opportunities in non-gaming for our team members in line with GEG’s commitment to support both upward and horizontal mobility including MICE as well as other non-gaming areas such as hospitality and food & beverage plus professional services such as marketing, information technology, human resources and finance.

On 15 September 2021, the Macau Government announced a 45-day public consultation of the "Legal Framework for the Operations of Casino Games of Fortune" which was completed on 29 October 2021.

We are pleased to report that during the quarter that infrastructure continued to improve. The new Macau-Zhuhai border checkpoint, Qingmao Checkpoint, was opened to travelers on 8 September 2021. The new checkpoint adopts the one-check approach and can handle an additional 200,000 crossings per day. The Central Government’s support of Macau is further confirmed through their commitment to strengthen the integration of Macau with Hengqin.

On 16 November 2021, the Macau Chief Executive will make his third Policy Address where we anticipate that he will outline Macau’s social welfare, economic development agenda and plans for the integration with Hengqin and Greater Bay Area.

We remain confident in the medium to longer term outlook of Macau. But we do acknowledge that shorter term periodic outbreaks of COVID-19 and subsequent travel restrictions can impact our financial results in the shorter term.

- END -

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award winning premium property.

The Group has the largest undeveloped landbank of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will double to more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG is also progressing plans for its Hengqin project and we are also expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM including Japan.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates. For more information about the Group, please visit www.galaxyentertainment.com

1 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the Group level the gaming statistics include Company owned resorts plus City Clubs.

2 Gaming statistics are presented before deducting commission and incentives.

3 Reflects junket rolling chip volume only.

4 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

6 NEG represents negative margin.

7 Gaming statistics are presented before deducting commission and incentives.

8 Reflects junket rolling chip volume only.

9 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

10 NEG represents negative margin.

11 Gaming statistics are presented before deducting commission and incentives.

12 Reflects junket rolling chip volume only.

13 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

14 NEG represents negative margin.

15 Gaming statistics are presented before deducting commission and incentives.

16 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

17 Gaming statistics are presented before deducting commission and incentives.

18 Reflects junket rolling chip volume only.

19 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.