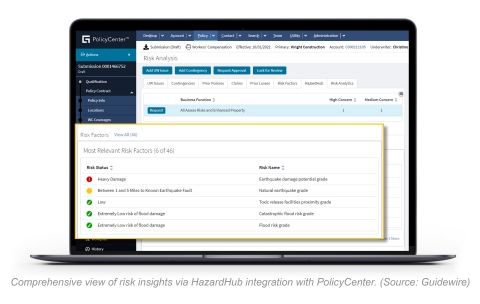

Guidewire Live's smart-loop analytics power the apps that provide insurers with curated intel from an array of high-value data sources. Live Apps are integrated with core systems and enable more accurate decision-making for claims managers, adjusters, underwriters, risk managers and actuaries. Support for open-source analytical models (Bring Your Own Model), new data visualizations, integration of HazardHub property risk insights with PolicyCenter, and greater internationalization capabilities are just a few of the latest innovations included in Guidewire Live.

“Traditionally, insurers have relied upon historical data to make decisions, but in today’s quickly changing market, this is no longer enough,” said Roger Arnemann, senior vice president and general manager, Analytics at Guidewire. “If insurers cannot react to what is happening now, they can’t succeed in the future. We are thrilled to introduce Guidewire Live as the industry’s first smart-loop analytics solution that enables insurers to outsmart, outpace, and outperform in a rapidly changing environment.”

In addition, new advances in the Dobson release of the Guidewire Cloud Platform (GWCP) deliver more cloud agility than ever before and empower developers to drive innovation.

- Guidewire GO**—The rapid expansion of our marketplace continues with GO Products, a new library of over 35 pre-packaged product definitions, so teams can launch new line of business products, fast.

- Cloud Integration Framework**—Reduce complexity across the insurance lifecycle with integrations that are easier to deploy and maintain with Integration Gateway, App Events and Cloud API.

- HazardHub—Now integrated with PolicyCenter, HazardHub provides risk insights for U.S. commercial property in seconds, delivering comprehensive risk data in one place.

- Blue-Green deployment—A new DevOps service that empowers developers to update configuration with zero downtime, enabling business continuity.

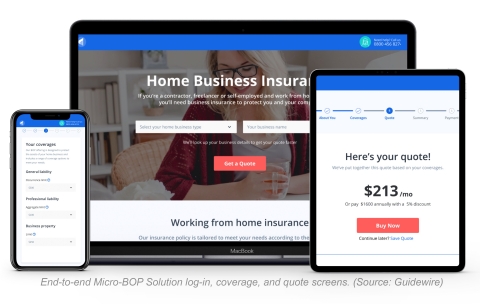

- Micro-BOP Solution—Deliver specialized experiences tailored to home-based businesses. Solutions include packaged product artifacts, configuration, and an expert team that help insurers go live with BOP coverage in as little as 12 weeks.

Guidewire was recently positioned as a Leader in the 2021 Gartner® Magic QuadrantTM for P&C Core Platforms, North America1 for InsuranceSuite, marking its seventh consecutive year in the report. Guidewire was also named a Challenger for the fifth consecutive time in the same report for InsuranceNow. In addition, Guidewire has been positioned as a Leader in the 2021 Gartner Magic Quadrant for Non-Life Insurance Platforms, Europe.2 This is the fourth consecutive year InsuranceSuite has been recognized in the report.

Read more about Guidewire Live on our website or read our blog post.

To learn more about Dobson, visit our website.

*Guidewire Live and Dobson release will be generally available on November 12, 2021.

**Indicates product feature is available for Early Access customers only.

1 Gartner, Magic Quadrant for P&C Core Platforms, North America, Sham Gill and James Ingham, September 14, 2021

2 Gartner, Magic Quadrant for Non-Life-Insurance Platforms, Europe, Sham Gill and James Ingham, September 27, 2021

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose. GARTNER and MAGIC QUADRANT are registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

About Guidewire

Guidewire is the platform P&C insurers trust to engage, innovate, and grow efficiently. We combine digital, core, analytics, and AI to deliver our platform as a cloud service. More than 450 insurers, from new ventures to the largest and most complex in the world, run on Guidewire.

As a partner to our customers, we continually evolve to enable their success. We are proud of our unparalleled implementation track record, with 1,000+ successful projects, supported by the largest R&D team and partner ecosystem in the industry. Our marketplace provides hundreds of applications that accelerate integration, localization, and innovation.

For more information, please visit www.guidewire.com and follow us on twitter: @Guidewire_PandC.

NOTE: All products mentioned in this announcement are Guidewire products. Not all products are available in every geography or to self-managed customers. Any unreleased services or features referenced in this or other press releases or public statements are not currently available and may not be delivered on time or at all. Customers who purchase Guidewire applications should make their purchase decisions based upon features that are currently available.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding the future availability of the Dobson release, the general availability of features, programs, services, and tools related to Dobson mentioned in this release such as, smart loop analytics, blue-green deployment and micro-BOP solution and the early access features, programs, services and tools related to Dobson, such as Guidewire GO and Cloud Integration Framework. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Guidewire’s control. Guidewire’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks detailed in Guidewire’s most recent Forms 10-K and 10-Q filed with the Securities and Exchange Commission as well as other documents that may be filed by the Company from time to time with the Securities and Exchange Commission. In particular, the following factors, among others, could cause results to differ materially from those expressed or implied by such forward-looking statements: quarterly and annual operating results may fluctuate more than expected; the impact of the COVID-19 pandemic on our employees and our business and the businesses of our customers, system integrator (“SI”) partners, and vendors; seasonal and other variations related to our customer agreements and related revenue recognition may cause significant fluctuations in our results of operations and cash flows; our reliance on sales to and renewals from a relatively small number of large customers for a substantial portion of our revenue; our ability to successfully manage any changes to our business model, including the transition of our products to cloud offerings and the costs related to cloud operations; our products or cloud-based services may experience data security breaches; we face intense competition in our market; our services revenue produces lower gross margins than our license, subscription and support revenue; our product development and sales cycles are lengthy and may be affected by factors outside of our control; changes in accounting guidance, such as revenue recognition, which have and may cause us to experience greater volatility in our quarterly and annual results; assertions by third parties that we violate their intellectual property rights could substantially harm our business; weakened global economic conditions may adversely affect the P&C insurance industry including the rate of information technology spending; general political or destabilizing events, including war, conflict or acts of terrorism; our ability to sell our products is highly dependent on the quality of our professional services and SI partners; the risk of losing key employees; the challenges of international operations, including changes in foreign exchange rates; and other risks and uncertainties. Past performance is not necessarily indicative of future results. The forward-looking statements included in this press release represent Guidewire’s views as of the date of this press release. The Company anticipates that subsequent events and developments will cause its views to change. Guidewire undertakes no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing Guidewire’s views as of any date subsequent to the date of this press release.

For information about Guidewire’s trademarks, visit https://www.guidewire.com/legal-notices.