HONG KONG--(BUSINESS WIRE)--Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three month and twelve month periods ended 31 December 2020. (All amounts are expressed in HKD unless otherwise stated)

LETTER FROM THE CHAIRMAN OF GALAXY ENTERTAINMENT GROUP

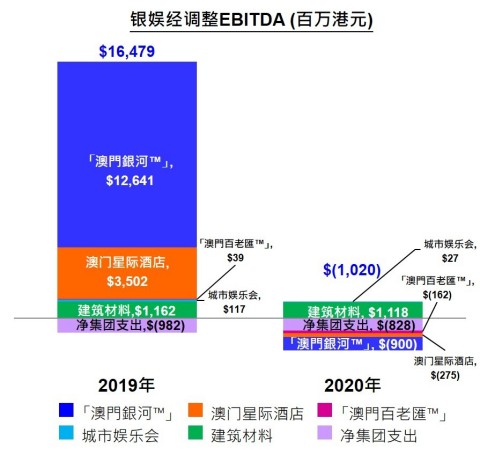

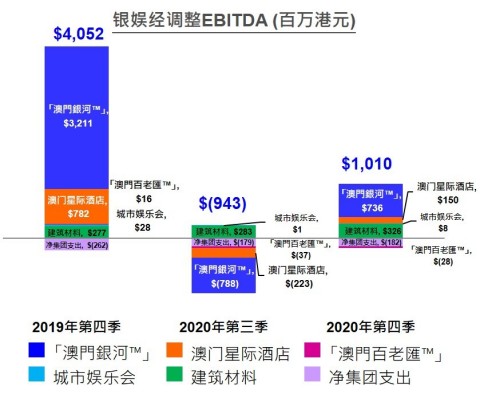

I wish to take this opportunity to update you on the status of Macau and the performance of GEG in 2020. COVID-19 has continued to impact the community and businesses globally including Macau and GEG. In Q4 2020, Mainland China, Hong Kong and Macau continued to experience travel restrictions and social distancing measures as they continued to effectively contain the pandemic. Given the subdued revenue the Group’s Adjusted EBITDA was $1.0 billion for the fourth quarter. This represents a 207% improvement compared to the Adjusted EBITDA loss of $0.9 billion reported in Q3. This improvement was largely driven by an increase in visitation which translated into increased revenue and continuing cost control. The full year Adjusted EBITDA was $(1.0) billion versus $16.5 billion in 2019.

We again applaud the Macau Government for their proactive leadership during the challenging pandemic crisis. Their focus is not only to ensure the health and safety of the community, but also ensuring that Macau is well positioned to attract visitors, support economic recovery and maintain the social stability of Macau.

We continue to make good progress with our development projects including Cotai Phases 3 & 4. In the meanwhile, we renovate, reconfigure and introduce new products to our resorts. In addition, we remain engaged in our international expansion plans including Japan, which is also being impacted by the pandemic.

Due to our conservative financial management, the Group’s net cash as at year end provides us with valuable flexibility in managing our ongoing operations and allows us to continue with our longer term development plans.

In the Macau Policy Address for 2021, Chief Executive Mr. Ho Iat Seng stated that the Government will promote the stable and healthy development of the gaming industry, and to commence preparatory and preliminary work for the new gaming concessions. We are looking forward to the launching of the public consultation in the 2H 2021.

Upholding the philosophy of “what is taken from the community is to be used for the good of the community”, we have been proactively supporting Macau and the Mainland during this epidemic. GEG has been working with the community to combat the outbreak through an array of practical initiatives, including: offering cash donations, donating hygiene & essential supplies, supporting local SMEs and providing timely assistance to numerous non-profit welfare and social service organizations and schools. In addition, GEG also adopted and supported all protective measures laid out by the Health Bureau of the Macau SAR Government and strengthened the epidemic prevention measures within our resorts.

In the medium to longer term, we have great confidence in the future of Macau. We have seen signs of early recovery post the reinstatement of the IVS in late September 2020 and it may take a few more quarters for business volumes to ramp up. However, we do acknowledge the ongoing difficulties associated with COVID-19 and potential future flare ups of COVID-19 could have a material adverse impact on our financial performance. Given the uncertainty caused by the COVID-19 pandemic, today the Board of Directors has decided not to declare a dividend.

We are pleased to hear that Macau and other locations are proceeding with their COVID-19 vaccination rollout plans. We believe that when Mainland and international tourists make future travel plans, health and safety will be foremost in their minds.

Finally, I would again like to acknowledge and thank the health and emergency personnel who have worked so hard to ensure the safety of Macau. I would also like to thank our staff, management team and Board of Directors who voluntarily contributed to the various cost savings programs and for being so supportive of our Company during this period of time. Thank you!

Dr. Lui Che Woo

GBM, MBE, JP, LLD, DSSc, DBA

Chairman

|

Q4 & FULL YEAR 2020 RESULTS HIGHLIGHTS

GEG: Well Capitalized to Weather the Storm

Galaxy Macau™: Adjusting Operations to the Current Business Environment

StarWorld Macau: Adjusting Operations to the Current Business Environment

Broadway Macau™: A Unique Family Friendly Resort, Strongly Supported by Macau SMEs

Balance Sheet: Healthy and Liquid Balance Sheet

Development Update: Continuing to Pursue Development Opportunities

|

Macau Market Overview

With the outbreak of COVID-19, the Macau Government acted rapidly and decisively to control the pandemic. Basically for the whole year of 2020 Macau was impacted by COVID-19 and the associated travel restrictions. Based on DICJ reporting, Macau’s Gross Gaming Revenue (“GGR”) for the full year 2020 was $58.7 billion, down 79% year-on-year. GGR in Q4 2020 was $21.2 billion, down 70% year-on-year and up 347% quarter-on-quarter.

Furthermore, border entry restrictions were introduced and combined with the ongoing IVS temporary suspension, customer arrivals were impacted. The IVS was progressively reinstated through the third quarter of 2020. However, the majority of Mainland Chinese visitors were not eligible to apply for travel to Macau until late September.

In 2020, visitor arrivals to Macau were 5.9 million, down 85% year-on-year, in which overnight visitors and same-day visitors both decreased 85% year-on-year. The average length of stay for overnight visitors increased by 0.6 day to 2.8 days. Mainland visitor arrivals to Macau were 4.8 million, down 83% year-on-year. For Q4 2020, visitor arrivals to Macau were 1.9 million, down 80% year-on-year and up 150% quarter-on-quarter. Mainland visitor arrivals to Macau were 1.7 million, down 73% year-on-year and up 155% quarter-on-quarter.

Group Financial Results

Full Year 2020

The Group posted net revenue of $12.9 billion, down 75% year-on-year. Adjusted EBITDA was $(1.0) billion versus $16.5 billion in 2019. Net profit attributable to shareholders was $(4.0) billion, down 130% year-on-year. Galaxy Macau™’s Adjusted EBITDA was $(0.9) billion versus $12.6 billion in 2019. StarWorld Macau’s Adjusted EBITDA was $(0.3) billion versus $3.5 billion in 2019. Broadway Macau™’s Adjusted EBITDA was $(0.2) billion versus $39.0 million in 2019.

GEG played lucky in its gaming operation during 2020, which increased its Adjusted EBITDA by approximately $25 million. Normalized 2020 Adjusted EBITDA was $(1.0) billion versus $15.7 billion in 2019.

The Group’s total GGR on a management basis1 in 2020 was $11.5 billion, down 81% year-on-year. Mass GGR was $6.1 billion, down 79% year-on-year. VIP GGR was $4.9 billion, down 82% year-on-year. Electronic GGR was $477 million, down 81% year-on-year.

|

Group Key Financial Data |

|

|

|||

|

(HK$'m) |

2019 |

2020 |

|||

|

Revenues: |

|

|

|||

|

Net Gaming |

43,582 |

8,566 |

|||

|

Non-gaming |

5,486 |

1,571 |

|||

|

Construction Materials |

2,834 |

2,739 |

|||

|

Total Net Revenue |

51,902 |

12,876 |

|||

|

|

|

|

|||

|

Adjusted EBITDA |

16,479 |

(1,020) |

|||

|

|

|

|

|||

|

Gaming Statistics2 |

|

|

|||

|

(HK$'m) |

2019 |

2020 |

|||

|

Rolling Chip Volume3 |

715,988 |

130,584 |

|||

|

Win Rate % |

3.9% |

3.8% |

|||

|

Win |

27,583 |

4,910 |

|||

|

|

|

|

|||

|

Mass Table Drop4 |

121,879 |

25,662 |

|||

|

Win Rate % |

24.0% |

23.9% |

|||

|

Win |

29,260 |

6,129 |

|||

|

|

|

|

|||

|

Electronic Gaming Volume |

67,942 |

14,131 |

|||

|

Win Rate % |

3.7% |

3.4% |

|||

|

Win |

2,513 |

477 |

|||

|

Total GGR Win5 |

59,356 |

11,516

|

Balance Sheet

Due to our conservative financial management, our balance sheet continues to remain strong. At the year end, cash and liquid investments were $46.0 billion. Total debt was $9.2 billion, including $8.7 billion associated with our treasury yield enhancement program and $0.5 billion of core debt. We remained virtually unlevered with net cash of $36.8 billion. This provides us with valuable flexibility in managing our ongoing operations and allows us to continue investing in our longer term development plans. Given the uncertainty caused by the COVID-19 pandemic, today the Board of Directors has decided not to declare a dividend.

Q4 2020

During Q4 2020, the Group’s net revenue decreased 61% year-on-year and increased 229% quarter-on-quarter to $5.1 billion. Adjusted EBITDA decreased 75% year-on-year and increased 207% quarter-on-quarter to $1.0 billion. Galaxy Macau™’s Adjusted EBITDA decreased 77% year-on-year and increased 193% quarter-on-quarter to $0.7 billion. StarWorld Macau’s Adjusted EBITDA decreased 81% year-on-year and increased 167% quarter-on-quarter to $0.2 billion. Broadway Macau™’s Adjusted EBITDA was $(28) million versus $(37) million in Q3 2020 and $16 million in Q4 2019.

During Q4 2020, GEG played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $59 million. Normalized Q4 2020 Adjusted EBITDA decreased 73% year-on-year and increased 214% quarter-on-quarter to $1.1 billion.

The Group’s total GGR on a management basis6 in Q4 2020 was $4.6 billion, down 68% year-on-year and up 436% quarter-on-quarter. Mass GGR was $2.8 billion, down 62% year-on-year, up 685% quarter-on-quarter. VIP GGR was $1.6 billion, down 74% year-on-year and up 249% quarter-on-quarter. Electronic GGR was $178 million, down 73% year-on-year and up 394% quarter-on-quarter.

|

Group Key Financial Data |

|

|

||||||||

|

(HK$'m) |

|

|

|

|

|

|||||

|

Q4 2019 |

Q3 2020 |

Q4 2020 |

FY2019 |

FY2020 |

||||||

|

Revenues: |

|

|

|

|

|

|||||

|

Net Gaming |

10,745 |

593 |

3,651 |

43,582 |

8,566 |

|||||

|

Non-gaming |

1,426 |

246 |

646 |

5,486 |

1,571 |

|||||

|

Construction Materials |

802 |

711 |

806 |

2,834 |

2,739 |

|||||

|

Total Net Revenue |

12,973 |

1,550 |

5,103 |

51,902 |

12,876 |

|||||

|

|

|

|

|

|

||||||

|

Adjusted EBITDA |

4,052 |

(943) |

1,010 |

16,479 |

(1,020) |

|||||

|

|

|

|

|

|

|

|||||

|

Gaming Statistics7 |

|

|

|

|

|

|||||

|

(HK$'m) |

|

|

|

|

|

|||||

|

Q4 2019 |

Q3 2020 |

Q4 2020 |

FY2019 |

FY2020 |

||||||

|

Rolling Chip Volume8 |

168,975 |

11,801 |

43,910 |

715,988 |

130,584 |

|||||

|

Win Rate % |

3.8% |

4.0% |

3.8% |

3.9% |

3.8% |

|||||

|

Win |

6,460 |

472 |

1,648 |

27,583 |

4,910 |

|||||

|

|

|

|

|

|

||||||

|

Mass Table Drop9 |

30,601 |

1,654 |

12,037 |

121,879 |

25,662 |

|||||

|

Win Rate % |

24.0% |

21.7% |

23.4% |

24.0% |

23.9% |

|||||

|

Win |

7,330 |

359 |

2,817 |

29,260 |

6,129 |

|||||

|

|

|

|

|

|

||||||

|

Electronic Gaming Volume |

17,984 |

1,324 |

4,322 |

67,942 |

14,131 |

|||||

|

Win Rate % |

3.7% |

2.7% |

4.1% |

3.7% |

3.4% |

|||||

|

Win |

659 |

36 |

178 |

2,513 |

477 |

|||||

|

|

|

|

|

|

|

|||||

|

Total GGR Win |

14,449 |

867 |

4,643 |

59,356 |

11,516 |

Galaxy Macau™

Galaxy Macau™ is the primary contributor to Group revenue and earnings. In 2020, net revenue was down 79% year-on-year to $7.8 billion. Adjusted EBITDA was $(0.9) billion versus $12.6 billion in 2019. Galaxy Macau™ played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $43 million. Normalized 2020 Adjusted EBITDA was $(0.9) billion versus $12.0 billion in 2019.

In Q4 2020, Galaxy Macau™’s net revenue was $3.3 billion, down 64% year-on-year and up 430% quarter-on-quarter. Adjusted EBITDA was $0.7 billion, down 77% year-on-year and up 193% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 22% (Q4 2019: 34%). Galaxy Macau™ played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $41 million. Normalized Q4 2020 Adjusted EBITDA decreased 74% year-on-year and up 199% quarter-on-quarter to $0.8 billion.

The combined five hotels occupancy rate was 49% for Q4 2020 and 28% for the full year 2020.

|

Galaxy Macau™ Key Financial Data |

|||||||||

|

(HK$'m) |

Q4 2019 |

Q3 2020 |

Q4 2020 |

FY2019 |

FY2020 |

||||

|

Revenues: |

|

|

|

|

|

||||

|

Net Gaming |

8,137 |

407 |

2,731 |

32,780 |

6,398 |

||||

|

Hotel / F&B / Others |

872 |

146 |

290 |

3,430 |

809 |

||||

|

Mall |

327 |

73 |

297 |

1,231 |

572 |

||||

|

Total Net Revenue |

9,336 |

626 |

3,318 |

37,441 |

7,779 |

||||

|

Adjusted EBITDA |

3,211 |

(788) |

736 |

12,641 |

(900) |

||||

|

Adjusted EBITDA Margin |

34% |

NEG10 |

22% |

34% |

NEG11 |

||||

|

|

|

|

|

|

|

||||

|

Gaming Statistics12 |

|

|

|

|

|

||||

|

(HK$'m) |

Q4 2019 |

Q3 2020 |

Q4 2020 |

FY2019 |

FY2020 |

||||

|

Rolling Chip Volume13 |

114,669 |

6,785 |

29,552 |

485,343 |

89,219 |

||||

|

Win Rate % |

4.0% |

4.6% |

3.9% |

4.2% |

4.1% |

||||

|

Win |

4,612 |

309 |

1,156 |

20,171 |

3,673 |

||||

|

|

|

|

|

|

|||||

|

Mass Table Drop14 |

18,359 |

860 |

7,348 |

72,786 |

14,994 |

||||

|

Win Rate % |

28.4% |

25.9% |

27.3% |

28.0% |

28.0% |

||||

|

Win |

5,221 |

223 |

2,009 |

20,411 |

4,198 |

||||

|

|

|

|

|

|

|||||

|

Electronic Gaming Volume |

11,872 |

746 |

3,064 |

45,572 |

8,755 |

||||

|

Win Rate % |

4.5% |

3.2% |

5.0% |

4.6% |

4.2% |

||||

|

Win |

539 |

23 |

153 |

2,076 |

368 |

||||

|

|

|

|

|

|

|

||||

|

Total GGR Win |

10,372 |

555 |

3,318 |

42,658 |

8,239 |

||||

StarWorld Macau

In 2020, StarWorld Macau’s net revenue was down 80% year-on-year to $2.2 billion. Adjusted EBITDA was $(0.3) billion versus $3.5 billion in 2019. StarWorld Macau played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $17 million. Normalized 2020 Adjusted EBITDA was $(0.3) billion versus $3.3 billion in 2019.

In Q4 2020, StarWorld Macau’s net revenue was $1.0 billion, down 64% year-on-year and up 380% quarter-on-quarter. Adjusted EBITDA was $0.2 billion, down 81% year-on-year and up 167% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 16% (Q4 2019: 29%). StarWorld Macau played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $18 million. Normalized Q4 2020 Adjusted EBITDA decreased 79% year-on-year and increased 176% quarter-on-quarter to $0.2 billion.

Hotel occupancy was 57% for Q4 2020 and 28% for the full year 2020.

|

StarWorld Macau Key Financial Data |

|||||||||

|

(HK$’m) |

|

|

|||||||

|

Q4 2019 |

Q3 2020 |

Q4 2020 |

FY2019 |

FY2020 |

|||||

|

Revenues: |

|

|

|

|

|

||||

|

Net Gaming |

2,515 |

184 |

914 |

10,403 |

2,119 |

||||

|

Hotel / F&B / Others |

125 |

10 |

35 |

461 |

99 |

||||

|

Mall |

13 |

5 |

6 |

53 |

19 |

||||

|

Total Net Revenue |

2,653 |

199 |

955 |

10,917 |

2,237 |

||||

|

Adjusted EBITDA |

782 |

(223) |

150 |

3,502 |

(275) |

||||

|

Adjusted EBITDA Margin |

29% |

NEG15 |

16% |

32% |

NEG16 |

||||

|

|

|

|

|

|

|

||||

|

Gaming Statistics17 |

|

|

|

|

|

||||

|

(HK$'m) |

|

|

|

|

|

||||

|

Q4 2019 |

Q3 2020 |

Q4 2020 |

FY2019 |

FY2020 |

|||||

|

Rolling Chip Volume18 |

50,539 |

4,429 |

13,280 |

222,014 |

37,434 |

||||

|

Win Rate % |

3.5% |

3.3% |

3.6% |

3.2% |

3.0% |

||||

|

Win |

1,770 |

148 |

481 |

7,118 |

1,140 |

||||

|

|

|

|

|

|

|||||

|

Mass Table Drop19 |

9,217 |

619 |

3,957 |

36,274 |

8,474 |

||||

|

Win Rate % |

17.5% |

16.9% |

16.9% |

18.7% |

18.1% |

||||

|

Win |

1,614 |

105 |

668 |

6,787 |

1,535 |

||||

|

|

|

|

|

|

|||||

|

Electronic Gaming Volume |

2,421 |

155 |

584 |

8,632 |

2,099 |

||||

|

Win Rate % |

2.2% |

2.3% |

2.1% |

2.3% |

2.2% |

||||

|

Win |

55 |

4 |

11 |

196 |

45 |

||||

|

|

|

|

|

|

|

||||

|

Total GGR Win |

3,439 |

257 |

1,160 |

14,101 |

2,720 |

||||

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs, it does not have a VIP gaming component. In 2020, Broadway Macau™’s net revenue was $94 million, down 84% year-on-year. Adjusted EBITDA was $(0.2) billion versus $39 million in 2019. Broadway Macau™ played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $1 million. Normalized 2020 Adjusted EBITDA was $(0.2) billion versus $34 million in 2019.

In Q4 2020, Broadway Macau™’s net revenue was $16 million, down 90% year-on-year, up 23% quarter-on-quarter. Adjusted EBITDA was $(28) million, versus $16 million in prior year and $(37) million in Q3 2020. There was no luck impact on Broadway Macau™’s Adjusted EBITDA in Q4 2020.

Hotel occupancy was 22% for Q4 2020 and 20% for full year 2020.

|

Broadway Macau™ Key Financial Data |

|||||||||

|

(HK$'m) |

|

|

|||||||

|

Q4 2019 |

Q3 2020 |

Q4 2020 |

FY2019 |

FY2020 |

|||||

|

Revenues: |

|

|

|

|

|

||||

|

Net Gaming |

65 |

1 |

0 |

282 |

22 |

||||

|

Hotel / F&B / Others |

78 |

6 |

10 |

267 |

49 |

||||

|

Mall |

11 |

6 |

6 |

44 |

23 |

||||

|

Total Net Revenue |

154 |

13 |

16 |

593 |

94 |

||||

|

Adjusted EBITDA |

16 |

(37) |

(28) |

39 |

(162) |

||||

|

Adjusted EBITDA Margin |

10% |

NEG20 |

NEG21 |

7% |

NEG22 |

||||

|

|

|

|

|

|

|

||||

|

Gaming Statistics23 |

|

|

|

|

|

||||

|

(HK$'m) |

|

|

|

|

|

||||

|

Q4 2019 |

Q3 2020 |

Q4 2020 |

FY2019 |

FY2020 |

|||||

|

Mass Table Drop24 |

320 |

NIL* |

NIL* |

1,334 |

114 |

||||

|

Win Rate % |

19.1% |

NIL* |

NIL* |

20.0% |

17.9% |

||||

|

Win |

61 |

NIL* |

NIL* |

267 |

20 |

||||

|

|

|

|

|

|

|||||

|

Electronic Gaming Volume |

471 |

36 |

7 |

1,923 |

337 |

||||

|

Win Rate % |

2.3% |

2.4% |

1.5% |

2.4% |

2.1% |

||||

|

Win |

11 |

1 |

0 |

47 |

7 |

||||

|

|

|

|

|

|

|

||||

|

Total GGR Win |

72 |

1 |

0 |

314 |

27 |

||||

* NIL represents tables not opened during the period.

City Clubs

City Clubs contributed $27 million of Adjusted EBITDA in 2020, down 77% year-on-year. Q4 2020 Adjusted EBITDA was $8 million, versus $28 million in prior year and $1 million in Q3 2020.

|

City Clubs Key Financial Data |

||||||||||

|

(HK$'m) |

Q4 2019 |

Q3 2020 |

Q4 2020 |

FY2019 |

FY2020 |

|||||

|

Adjusted EBITDA |

28 |

1 |

8 |

117 |

27 |

|||||

|

|

|

|

|

|

|

|||||

|

Gaming Statistics25 |

|

|

|

|

||||||

|

(HK$'m) |

|

|

|

|

|

|||||

|

Q4 2019 |

Q3 2020 |

Q4 2020 |

FY2019 |

FY2020 |

||||||

|

Rolling Chip Volume26 |

3,767 |

587 |

1,078 |

8,631 |

3,931 |

|||||

|

Win Rate % |

2.1% |

2.4% |

1.1% |

3.4% |

2.5% |

|||||

|

Win |

78 |

15 |

11 |

294 |

97 |

|||||

|

|

|

|

|

|

|

|||||

|

Mass Table Drop27 |

2,705 |

175 |

732 |

11,485 |

2,080 |

|||||

|

Win Rate % |

16.1% |

17.8% |

19.2% |

15.6% |

18.1% |

|||||

|

Win |

434 |

31 |

140 |

1,795 |

376 |

|||||

|

|

|

|

|

|

||||||

|

Electronic Gaming Volume |

3,220 |

387 |

667 |

11,815 |

2,940 |

|||||

|

Win Rate % |

1.7% |

2.0% |

1.9% |

1.6% |

1.9% |

|||||

|

Win |

54 |

8 |

14 |

194 |

57 |

|||||

|

|

|

|

|

|

|

|||||

|

Total GGR Win |

566 |

54 |

165 |

2,283 |

530 |

|||||

Construction Materials Division

The Construction Materials Division contributed Adjusted EBITDA of $1.1 billion in 2020, down 4% year-on-year. Q4 2020 Adjusted EBITDA was $326 million, up 18% year-on-year and up 15% quarter-on-quarter.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests.

Cotai – The Next Chapter

GEG is uniquely positioned for long term growth. We are proceeding with the development of Phases 3 & 4 and continue to review and refine plans to ensure a world-class optimal development. We see the premium market evolving with this segment preferring higher quality and spacious rooms. Phases 3 & 4 combined will have approximately 3,000 high end and family rooms and villas, 400,000 square feet of MICE space, a 500,000 square feet 16,000-seat multi-purpose arena, F&B, retail and casinos, among others. We will try to maintain our development targets, however due to COVID-19, development timelines may be impacted. At this point we cannot quantify the impact but we will endeavor to maintain our schedule.

Hengqin / Greater Bay Area

We continue to make progress with the planning of our project on Hengqin that will complement our high energy resorts in Macau.

We are also expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area.

International

Our Japan based team continues with our Japan development efforts even as they deal with the COVID-19 crisis. We view Japan as a long term growth opportunity that will complement our Macau operations and our other international expansion ambitions. GEG, together with Monte-Carlo SBM from the Principality of Monaco and our Japanese partners, remain interested in bringing our brand of World Class IRs to Japan.

Selected Major Awards for 2020

|

Award |

Presenter |

|

GEG |

|

|

Mr. Francis Lui, Vice Chairman of Galaxy Entertainment Group – Rank No.1 |

13th Asian Gaming Power 50 |

|

Casino Operator of the Year Australia & Asia Socially Responsible Operator (Asia / Australia) |

13th International Gaming Awards |

|

Certificate of Excellence in Investor Relations |

HKIRA 6th Investor Relations Awards |

|

Best in Sector – Consumer Discretionary Certificate of Excellence in Investor Relations |

IR Magazine Greater China Awards 2020 |

|

The Most Influential Social Responsibility Award |

The 2nd Greater China Most Influential Brand & Entrepreneur Awards Ceremony |

|

Employer Recognition for the Hiring "Senior Talents” |

2020 Outstanding Elderly Employees Award and Employer Recognition Scheme for the Hiring of “Senior Talents” |

|

Original Convention and Exhibition Award |

Macao Convention and Exhibition Commendation Awards 2020 |

|

Galaxy Macau™ |

|

|

Five-Star Hotel:

Five-Star Restaurant: - Lai Heen - Belon

Five-Star Spa: - The Ritz-Carlton Spa, Macau - Banyan Tree Spa Macau |

2020 Forbes Travel Guide |

|

Energy Saving Concept Award Excellence Award |

Macau Energy Saving Activity 2020 |

|

Best of the Best Awards Top 10 Hotels for Families - China

Travelers’ Choice Winner: - The Ritz-Carlton, Macau - Banyan Tree Macau - Hotel Okura Macau - JW Marriott Hotel Macau |

Tripadvisor 2020 Travelers' Choice |

|

Best of the Best 2020 - The Best Shopping Experience |

Robb Report China |

|

2019 Macau Green Hotel Awards - Gold Award: - Banyan Tree Macau - JW Marriott Hotel Macau - The Ritz-Carlton, Macau |

DSPA & MGTO

|

|

Annual Gourmet Landmark - Galaxy Macau™ Special Recommended Must Eat Restaurant - Fook Lam Moon |

2019-2020 China Feast Restaurant Awards by Restaurant Review |

|

Macau's Best Resort Spa 2020 - Banyan Tree Spa Macau |

World Spa Awards |

|

Most Anticipated Hotel - Andaz Macau Most Anticipated Convention Center - Galaxy International Convention Center |

2020 Golden Five Stars Award by China International Conference & Exhibition |

|

StarWorld Macau |

|

|

My Favorite Hotel Restaurant in Macau - Feng Wei Ju |

U Magazine Favorite Food Awards 2020 |

|

I Food Award 2020 - My Favorite Restaurant in Hotel - Feng Wei Ju |

I Food Award |

|

Broadway Macau™ |

|

|

Agoda Customer Review Award 2020 |

Agoda.com |

|

Travelers’ Choice Winner |

TripAdvisor 2020 Travelers' Choice |

|

Loved by Guests Award 2020 |

Hotels.com |

|

Construction Materials Division |

|

|

Caring Company Scheme – 15 Years Plus Caring Company Logo |

The Hong Kong Council of Social Service |

|

Occupational Health Award 2019-20 - Joyful @ Healthy Workplace Best Practices Award (Enterprise / Organisation Category) - Grand Award |

Occupational Safety and Health Council |

|

Construction Industry Caring Organization |

Construction Industry Sports and Volunteering Programme |

|

Hong Kong Awards for Environmental Excellence – Manufacturing and Industrial Services – Certificate of Merit

Hong Kong Green Organisation Certification - Wastewi$e - Certificate - Excellence Level - - Carbon Reduction - Certificate – Achieved 7% Carbon Reduction |

Environmental Campaign Committee |

|

Good Employer Charter 2020: - Signatory of the Good Employer Charter 2020 - Family-friendly Good Employer Logo |

Labour Department |

|

BOCHK Corporate Environmental Leadership Awards 2019 – Eco Partner, 3 Years+ Eco Pioneer |

Bank of China (Hong Kong); Federation of Hong Kong Industries |

|

Social Capital Builder Awards – Social Capital Leader Logo Award |

Labour and Welfare Bureau; Community Investment and Inclusion Fund |

Outlook

We believe that COVID-19 will continue to impact Macau for the immediate future. Mainland China, Hong Kong and Macau continue to experience social distancing measures and travel restrictions which have been progressively easing. We are pleased with the progressive reinstatement of the IVS visas in Mainland through Q3 2020 and we expect visitation to improve as Macau benefits from the ramping up of the IVS program. In the medium to longer term, we have great confidence in the future of Macau. However, we do acknowledge the ongoing difficulties associated with COVID-19 and the potential for COVID-19 to materially adversely impact our future financial results.

The expanded infrastructure will continue to improve the accessibility to Macau. In particular, the new Hengqin immigration port and the extension line of Zhuhai Urban-Airport Intercity Railway which commenced operation in August 2020. In addition, the Macau Government plans to repurpose part of the Taipa Ferry Terminal into the second terminal building of the Macau International Airport and increase the total airport capacity. The Macau Government also plans to build the east section of the Light Rail Transport which will connect the peninsula’s Gongbei Border Gate checkpoint to the Taipa Ferry Terminal.

We are pleased to hear that Macau and other locations are proceeding with their COVID-19 vaccination rollout plans. We believe that when Mainland and international tourists make future travel plans, health and safety will be foremost in their minds.

Specifically, to GEG, the Group is ready to capture future growth with our substantial development pipeline. These include the ongoing development of Cotai Phases 3 & 4 which are specifically designed to capture a larger share of the Mass business, renovate the existing properties, reconfigure and introduce new products to our resorts to ensure they remain highly competitive and appealing to our valuable guests. These projects will support Macau’s economy in the near term.

We remain engaged in our international expansion plans including Japan. We understand that due to the impact of COVID-19, Japan has revised their timeline of Integrated Resorts licenses and we remain interested in introducing our brands to Japan.

In the shorter to medium term, we do acknowledge it is hard to determine the speed of recovery with anticipated progressive-opening of travel restrictions and expected social distancing within our resorts. Further, we are also mindful that consumer sentiment has been impacted by a slower global economy, ongoing trade tensions and currency fluctuation among others. These events have been impacting consumer sentiment and subsequent spending habits. Longer term, we have great confidence in Macau and we will continue with our development program. GEG remains committed to support the Government’s vision to develop Macau into a World Center of Tourism and Leisure.

Through our prudent business management, GEG has a strong and virtually unlevered balance sheet. This allows us to continue to invest into and upgrade our existing resorts and proceed with the planned opening of Cotai Phases 3 & 4. During the period of low revenue, we will continue to focus on effective cost control. However, we are mindful not to cut costs excessively and therefore adversely impact our renowned “World Class, Asian Heart” service standards and customer experiences.

- END -

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award winning premium property.

The Group has the largest undeveloped landbank of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will double to more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG is also progressing plans for its Hengqin project and we are also expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Etrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM including Japan.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group, please visit www.galaxyentertainment.com

1 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the group level the gaming statistics include Company owned resorts plus City Clubs.2 Gaming statistics are presented before deducting commission and incentives.

3 Reflects junket rolling chip volume only.

4 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

6 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the group level the gaming statistics include Company owned resorts plus City Clubs.

7 Gaming statistics are presented before deducting commission and incentives.

8 Reflects junket rolling chip volume only.

9 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

10 NEG represents negative margin.

11 NEG represents negative margin.

12 Gaming statistics are presented before deducting commission and incentives.

13 Reflects junket rolling chip volume only.

14 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

15 NEG represents negative margin.

16 NEG represents negative margin.

17 Gaming statistics are presented before deducting commission and incentives.

18 Reflects junket rolling chip volume only.

19 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

20 NEG represents negative margin.

21 NEG represents negative margin.

22 NEG represents negative margin.

23 Gaming statistics are presented before deducting commission and incentives.

24 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

25 Gaming statistics are presented before deducting commission and incentives.

26 Reflects junket rolling chip volume only.

27 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.