4Q12 Net Advertising Revenues Up 28.4% YOY

FY2012 Net Advertising Revenues Up 31.0%

FY2012 Total Revenues Exceed RMB1.1 Billion

Live Conference Call to be Held at 8:00 PM U.S. Eastern Time on March 6

BEIJING--(Business Wire)--Phoenix New Media Limited (NYSE: FENG), a leading new media company in China ("Phoenix New Media", "ifeng" or the "Company"), today announced its unaudited financial results for the fourth quarter and fiscal year ended December 31, 2012.

Fourth Quarter and Fiscal Year 2012 Highlights

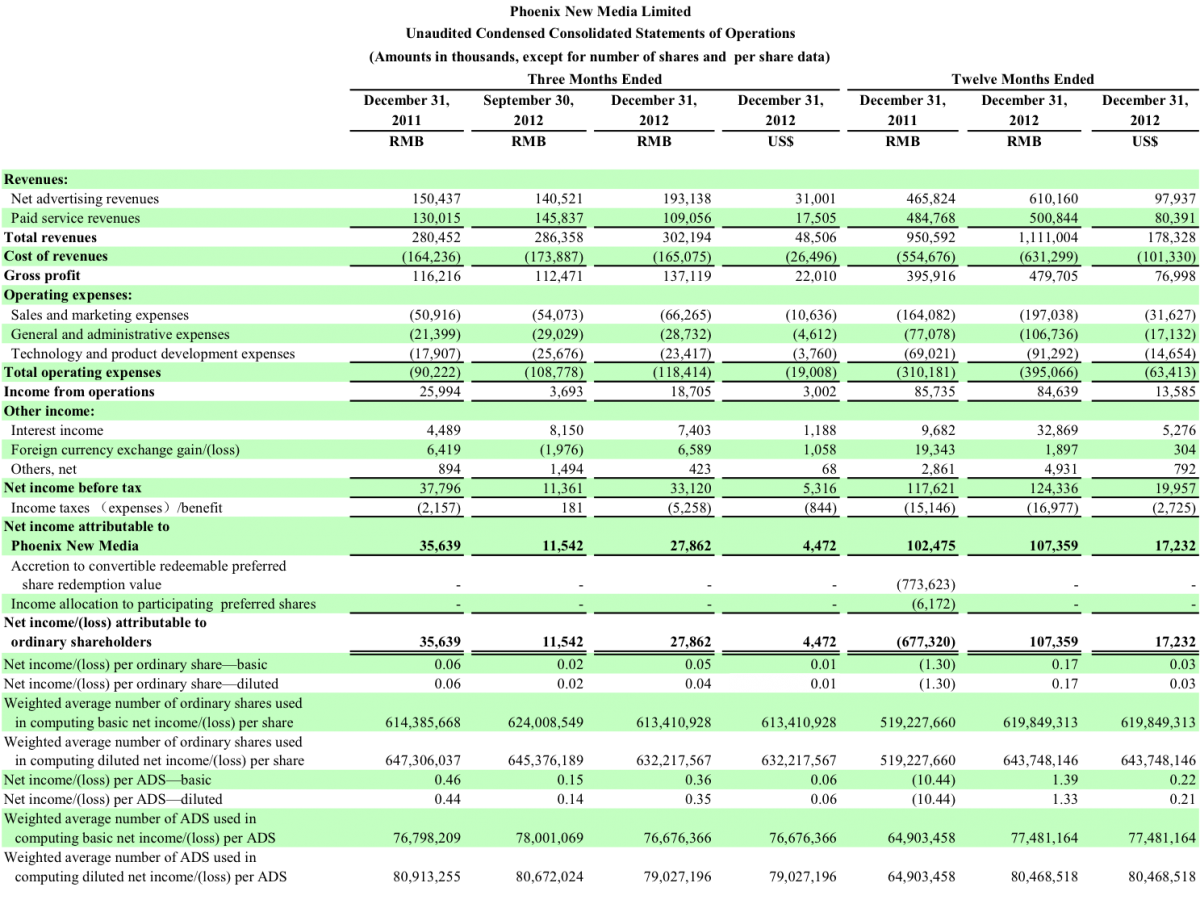

- Total revenues for the fourth quarter of 2012 increased by 7.8% year-over-year to RMB302.2 million (US$48.5 million), primarily driven by a 28.4% increase in net advertising revenues.

- Total revenues for fiscal year 2012 increased by 16.9% year-over-year to RMB1.1 billion (US$178.3 million), primarily driven by a 31.0% increase in net advertising revenues.

- Net income attributable to Phoenix New Media for fiscal year 2012 increased by 4.8% year-over-year to RMB107.4 million (US$17.2 million).

Mr. Shuang Liu, CEO of Phoenix New Media, stated, "We are very pleased that for the year of 2012, we continued to outpace other major online portals in China with our online advertising revenue growing 31.0% and the number of daily unique visitors growing 63.8% year-over-year. In particular, we are very encouraged to see a sizeable rebound in our advertising sales in the fourth quarter, which speaks to the success of our strategy and operation. As a result of our recently streamlined sales operation, we have realized strong growth in APRA over the quarter while enhancing our client base and relationships. Benefiting from our proprietary content offering, our video advertising sales have led to an incremental increase in both sales and number of clients, providing us with additional revenue streams for this quarter and beyond.

Going forward, as one of China's most influential media companies, we are confident that our strategy of expanding exclusive and premium content across PC and mobile Internet platforms, coupled with our proven execution capabilities, will further strengthen our influence in today's increasingly digital and mobile world."

Fourth Quarter 2012 Financial Results

REVENUES

Total revenues for the fourth quarter of 2012 increased by 7.8% to RMB302.2 million (US$48.5 million) from RMB280.5 million in the fourth quarter of 2011.

Net advertising revenues, calculated net of advertising agency service fees, for the fourth quarter of 2012 increased by 28.4% to RMB193.1 million (US$31.0 million) from RMB150.4 million in the fourth quarter of 2011, primarily due to an increase in average revenue per advertiser ("ARPA") of 26.4% to RMB605,450 (US$97,180) for 319 total advertisers.

Paid service revenues for the fourth quarter of 2012 decreased by 16.1% to RMB109.1 million (US$17.5 million) from RMB130.0 million in the fourth quarter of 2011. Mobile Internet and value-added services ("MIVAS")[1] revenues decreased by 20.0% to RMB95.3 million (US$15.3 million) in the fourth quarter of 2012 from RMB119.1 million in the fourth quarter of 2011 due to the expected decrease in user demand from 2G text message based wireless value-added services ("WVAS"). Video value-added services ("video VAS") revenues increased by 26.1% to RMB13.7 million (US$2.2 million) in the fourth quarter of 2012 from RMB10.9 million in the fourth quarter of 2011, primarily due to an expansion in video VAS user base across the three major telecom operators in China.

COST OF REVENUES AND GROSS PROFIT

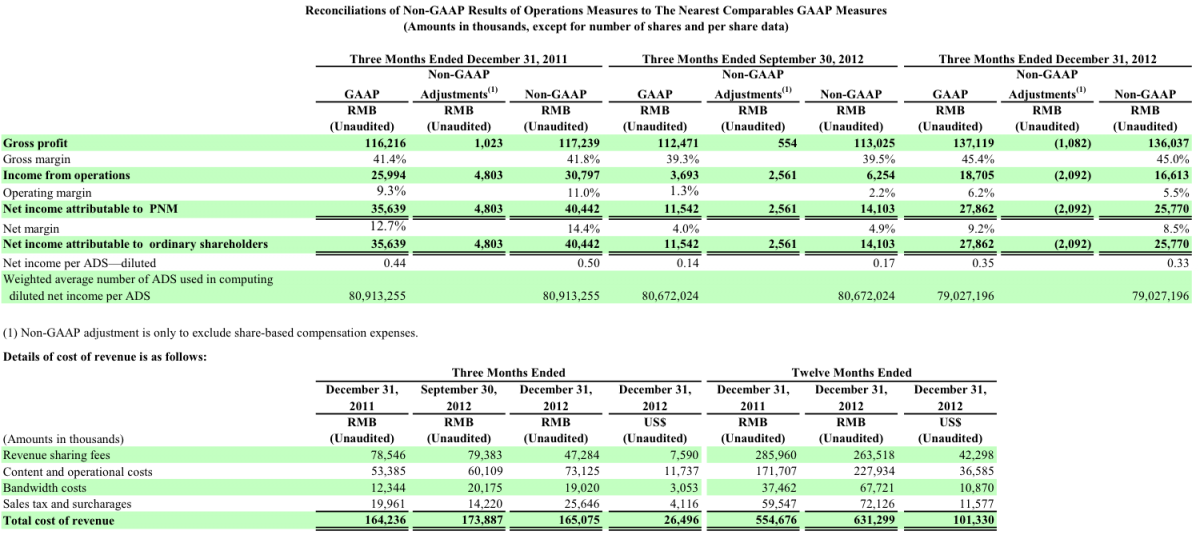

Cost of revenues for the fourth quarter of 2012 increased by 0.5% to RMB165.1 million (US$26.5 million) from RMB164.2 million in the fourth quarter of 2011. Revenue sharing fees to telecom operators and channel partners decreased to RMB47.3 million (US$7.6 million) in the fourth quarter of 2012 from RMB78.5 million in the fourth quarter of 2011, primarily due to the decrease in MIVAS revenues. Content and operational costs increased to RMB73.1 million (US$11.7 million) in the fourth quarter of 2012 from RMB53.4 million in the fourth quarter of 2011 due to the increase in staff-related costs, office rental fees, as well as the increase in content production and acquisition costs. Bandwidth costs increased to RMB19.0 million (US$3.1 million) in the fourth quarter of 2012 from RMB12.3 million in the fourth quarter of 2011 primarily due to the significant growth in user traffic. Sales tax and surcharges increased to RMB25.6 million (US$4.1 million) in the fourth quarter of 2012 from RMB20.0 million in the fourth quarter of 2011. Share-based compensation expenses included in cost of revenues was negative RMB1.1 million (US$0.2 million) in the fourth quarter of 2012 as compared to RMB1.0 million in the fourth quarter of 2011, primarily due to the adjustment of the estimated forfeiture rate[2].

Gross profit for the fourth quarter of 2012 increased by 18.0% to RMB137.1 million (US$22.0 million) from RMB116.2 million in the fourth quarter of 2011. Gross margin increased to 45.4% in the fourth quarter of 2012 from 41.4% in the fourth quarter of 2011, mainly due to the increased revenue contribution from higher-margin advertising services business, partially offset by the aforementioned increase in content and operational costs. Adjusted gross margin[3], which excludes share-based compensation expenses, increased to 45.0% in the fourth quarter of 2012 from 41.8% in the fourth quarter of 2011.

OPERATING EXPENSES AND INCOME FROM OPERATIONS

Total operating expenses for the fourth quarter of 2012 increased by 31.2% to RMB118.4 million (US$19.0 million) from RMB90.2 million in the fourth quarter of 2011. The increase in operating expenses was primarily attributable to the increase in staff-related costs, sales and marketing expenses associated with the Company's marketing and promotions, and office rental fees. Share-based compensation expenses included in operating expenses were negative RMB1.0 million (US$0.2 million) in the fourth quarter of 2012 as compared to RMB3.8 million in the fourth quarter of 2011, primarily due to the adjustment of the estimated forfeiture rate.

Income from operations for the fourth quarter of 2012 was RMB18.7 million (US$3.0 million) as compared to RMB26.0 million in the fourth quarter of 2011. Operating margin was 6.2% for the fourth quarter of 2012 as compared to 9.3% in the fourth quarter of 2011. The decrease in operating margin was primarily due to the increase in staff-related costs, sales and marketing expenses associated with the Company's marketing and promotions, and office rental fees.

Adjusted income from operations, which excludes the impact of share-based compensation expenses, for the fourth quarter of 2012 was RMB16.6 million (US$2.7 million) as compared to RMB30.8 million in the fourth quarter of 2011. Adjusted operating margin was 5.5% for the fourth quarter of 2012 as compared to 11.0% in the fourth quarter of 2011.

FOREIGN CURRENCY EXCHANGE GAIN/LOSS AND INTEREST INCOME

Foreign currency exchange gain for the fourth quarter of 2012 was RMB6.6 million (US$1.1 million), as compared to RMB6.4 million in the fourth quarter of 2011. Interest income for the fourth quarter of 2012 was RMB7.4 million (US$1.2 million), as compared to RMB4.5 million in the fourth quarter of 2011.

NET INCOME

Net income attributable to Phoenix New Media for the fourth quarter of 2012 was RMB27.9 million (US$4.5 million) as compared to RMB35.6 million in the fourth quarter of 2011. Net margin for the fourth quarter of 2012 was 9.2% as compared to 12.7% in the fourth quarter of 2011. Net income per diluted ADS[4] in the fourth quarter of 2012 was RMB0.35 (US$0.06) as compared to RMB0.44 in the fourth quarter of 2011.

Adjusted net income attributable to Phoenix New Media for the fourth quarter of 2012, which excludes share-based compensation expenses, was RMB25.8 million (US$4.1 million) as compared to RMB40.4 million in the fourth quarter of 2011. Adjusted net margin for the fourth quarter of 2012 was 8.5% as compared to 14.4% in the fourth quarter of 2011. Adjusted net income per diluted ADS was RMB0.33 (US$0.05) in the fourth quarter of 2012, as compared to RMB0.50 in the fourth quarter of 2011.

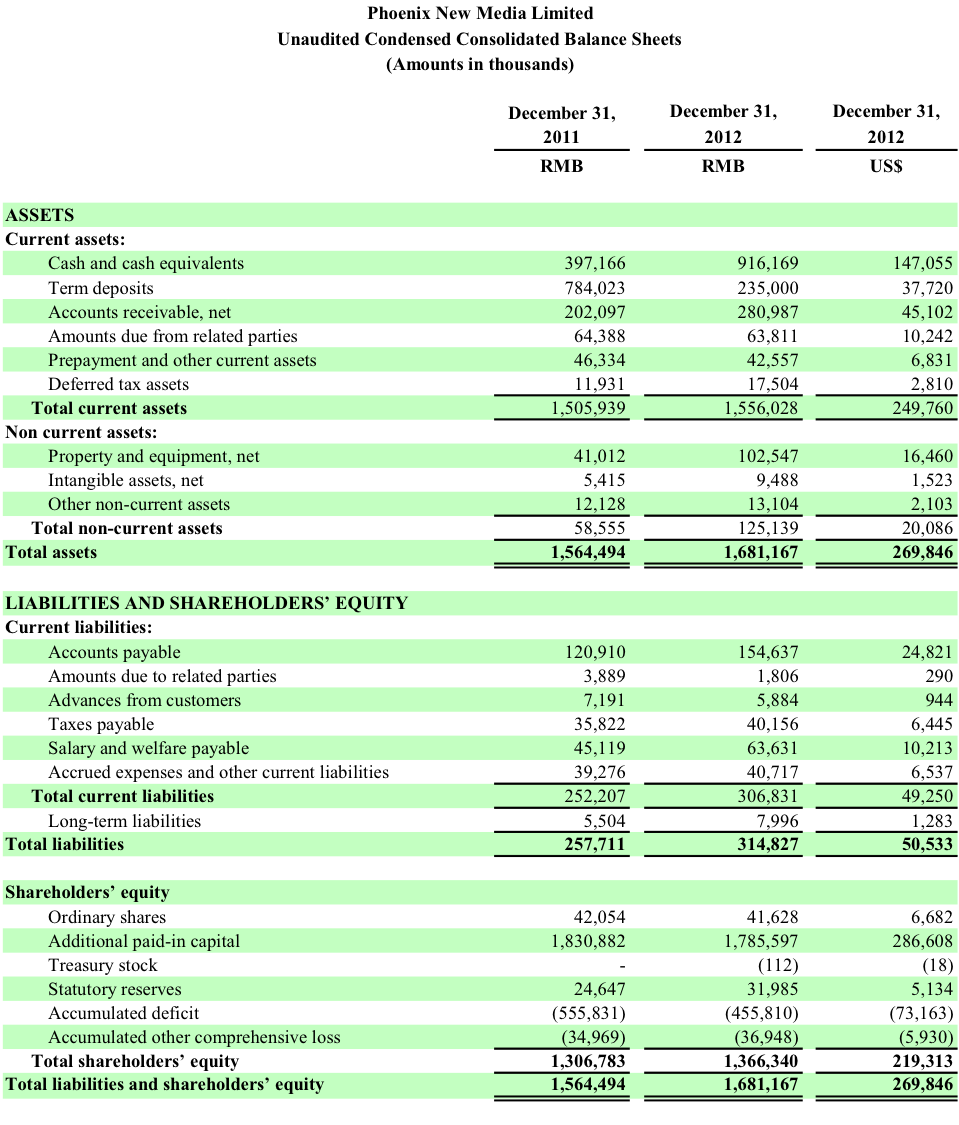

As of December 31, 2012, the Company's cash, cash equivalents and term deposits was RMB1.2 billion (US$184.8 million).

For the fourth quarter of 2012, the Company's weighted average number of ADS used in computing diluted net income per ADS was 79,027,196.

Fiscal Year 2012 Financial Results

REVENUES

Total revenues for fiscal year 2012 increased by 16.9% to RMB1.1 billion (US$178.3 million) from RMB950.6 million in fiscal year 2011.

Net advertising revenues, calculated net of advertising agency service fees, for fiscal year 2012 increased by 31.0% to RMB610.2 million (US$97.9 million) from RMB465.8 million in fiscal year 2011. This increase was primarily due to an increase in average revenue per advertiser ("ARPA") of 40.0% to RMB1.2 million (US$0.2 million) for 522 total advertisers.

Paid service revenues for fiscal year 2012 increased by 3.3% to RMB500.8 million (US$80.4 million) from RMB484.8 million in fiscal year 2011. The growth in paid service revenues primarily reflected the Company's efforts in product distribution, diversification and marketing activities.

COST OF REVENUES AND GROSS PROFIT

Cost of revenues for fiscal year 2012 increased by 13.8% to RMB631.3 million (US$101.3 million) from RMB554.7 million in fiscal year 2011. Share-based compensation expense included in cost of revenues was RMB1.0 million (US$0.2 million) in fiscal year 2012.

Gross profit for fiscal year 2012 increased by 21.2% to RMB479.7 million (US$77.0 million) from RMB395.9 million in fiscal year 2011.

Gross margin increased to 43.2% for fiscal year 2012 from 41.6% in fiscal year 2011. Adjusted gross margin, which excludes the impact of share-based compensation expense, decreased slightly to 43.3% for fiscal year 2012 from 43.7% in fiscal year 2011.

OPERATING EXPENSES AND INCOME FROM OPERATIONS

Total operating expenses for fiscal year 2012 increased by 27.4% to RMB395.1 million (US$63.4 million) from RMB310.2 million in fiscal year 2011. The increase in operating expenses was primarily due to the increase in staff-related costs, sales and marketing expenses associated with the Company's marketing and promotions, and office rental fees. Share-based compensation expense included in operating expenses was RMB5.8 million (US$0.9 million) in fiscal year 2012 as compared to RMB46.6 million in fiscal year 2011.

Income from operations for fiscal year 2012 was RMB84.6 million (US$13.6 million) as compared to RMB85.7 million in fiscal year 2011. Operating income margin was 7.6% for fiscal year 2012 as compared to 9.0% in fiscal year 2011.

Adjusted income from operations, which excludes the impact of share-based compensation expense, for fiscal year 2012 was RMB91.4 million (US$14.7 million) as compared to RMB151.8 million in fiscal year 2011. Adjusted operating income margin was 8.2% for fiscal year 2012, as compared to 16.0% in fiscal year 2011.

NET INCOME

Net income attributable to Phoenix New Media for fiscal year 2012 increased by 4.8% to RMB107.4 million (US$17.2 million) from RMB102.5 million in fiscal year 2011. Net margin for fiscal year 2012 was 9.7% as compared to 10.8% in fiscal year 2011. Net income attributable to ordinary shareholders for fiscal year 2012 was RMB107.4 million (US$17.2 million), as compared to a net loss attributable to ordinary shareholders of RMB677.3 million in fiscal year 2011. Net income per diluted ADS in fiscal year 2012 was RMB1.33 (US$0.21) as compared to a net loss per diluted ADS of RMB10.44 in fiscal year 2011.

Adjusted net income attributable to Phoenix New Media for fiscal year 2012, which excludes share-based compensation expenses, was RMB114.1 million (US$18.3 million) as compared to RMB168.6 million in fiscal year 2011. Adjusted net margin for fiscal year 2012 was 10.3% as compared to 17.7% in fiscal year 2011. Adjusted net income attributable to Phoenix New Media per diluted ADS was RMB1.42 (US$0.23) for fiscal year 2012, as compared to RMB2.23 in fiscal year 2011.

Business Outlook

For the first quarter of 2013, the Company expects its total revenues to be between RMB271 million and RMB280 million. Net advertising revenues are expected to be between RMB161 million and RMB166 million. Paid service revenues are expected to be between RMB110 million and RMB114 million. These forecasts reflect the Company's current and preliminary view on the market and operational conditions, which are subject to change.

Share Repurchase Program

As of December 31, 2012, the Company had repurchased an aggregate of 2,273,695 American Depositary Shares ("ADSs") at an aggregate cost of approximately US$8.3 million on the open market. Under its ADS repurchase program, the Company has been authorized to repurchase up to US$20.0 million of its outstanding ADSs for a period not exceeding twelve (12) months since August 2012. The Company expects to continue to implement its share repurchase program in a manner consistent with market conditions and the interest of its shareholders, subject to the restrictions relating to volume, price and timing under applicable law.

Conference Call Information

The Company will hold a conference call at 8:00p.m. U.S. Eastern Time on March 6, 2013 (March 7, 2013 at 9:00a.m. Beijing / Hong Kong time) to discuss its fourth quarter and fiscal year 2012 financial results and operating performance.

To participate in the call, please dial the following numbers:

International: +6567239385

China: 4001200654

Hong Kong: +85230512745

United States: +16462543515

Conference ID: 12811711

A replay of the call will be available through March 13, 2013 by dialing the following numbers:

International: +61281990299

China: 4001200932

United States: +18554525696

Hong Kong: +85230512780

Conference ID: 12811711

A live and archived webcast of the conference call will also be available at the Company's investor relations website at http://ir.ifeng.com

Use of Non-GAAP Financial Measures

To supplement the consolidated financial statements presented in accordance with the United States Generally Accepted Accounting Principles ("GAAP"), Phoenix New Media uses adjusted gross profit, adjusted gross margin, adjusted income from operations, adjusted operating margin, adjusted net income attributable to Phoenix New Media, adjusted net margin, adjusted net income attributable to ordinary shareholders and adjusted net income per diluted ADS, each of which is a non-GAAP financial measure. Adjusted gross profit is gross profit excluding share-based compensation expenses. Adjusted gross margin is adjusted gross profit divided by total revenues. Adjusted income from operations is income from operations excluding share-based compensation expenses. Adjusted operating margin is adjusted income from operations divided by total revenues. Adjusted net income attributable to Phoenix New Media is net income attributable to Phoenix New Media excluding share-based compensation expenses. Adjusted net margin is adjusted net income attributable to Phoenix New Media divided by total revenues. Adjusted net income attributable to ordinary shareholders is net income attributable to ordinary shareholders excluding share-based compensation expenses. Adjusted net income per diluted ADS is adjusted net income attributable to ordinary shareholders divided by weighted average number of diluted ADS. The Company believes that separate analysis and exclusion of the non-cash impact of share-based compensation adds clarity to the constituent parts of its performance. The Company reviews adjusted net income together with net income to obtain a better understanding of its operating performance. It uses this non-GAAP financial measure for planning, forecasting and measuring results against the forecast. The Company believes that using multiple measures to evaluate its business allows both management and investors to assess the company's performance against its competitors and ultimately monitor its capacity to generate returns for its investors. The Company also believes that non-GAAP financial measures are useful supplemental information for investors and analysts to assess its operating performance without the effect of non-cash share-based compensation expenses, which have been and will continue to be significant recurring expenses in its business. However, the use of non-GAAP financial measures has material limitations as an analytical tool. One of the limitations of using non-GAAP financial measures is that they do not include all items that impact the Company's net income for the period. In addition, because non-GAAP financial measures are not measured in the same manner by all companies, they may not be comparable to other similar titled measures used by other companies. In light of the foregoing limitations, you should not consider non-GAAP financial measure in isolation from or as an alternative to the financial measure prepared in accordance with U.S. GAAP.

Exchange Rate

This announcement contains translations of certain RMB amounts into U.S. dollars ("USD") at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from RMB to USD were made at the rate of RMB6.2301 to US$1.00, the noon buying rate in effect on December 31, 2012 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or USD amounts referred could be converted into USD or RMB, as the case may be, at any particular rate or at all. For analytical presentation, all percentages are calculated using the numbers presented in the financial statements contained in this earnings release.

About Phoenix New Media Limited

Phoenix New Media Limited (NYSE: FENG) is the leading new media company providing premium content on an integrated platform across Internet, mobile and TV channels in China. Having originated from a leading global Chinese language TV network based in Hong Kong, Phoenix TV, the Company enables consumers to access professional news and other quality information and share user-generated content on the Internet and through their mobile devices. Phoenix New Media's platform includes its ifeng.com channel, consisting of its ifeng.com website, its video channel, comprised of its dedicated video vertical and video services and applications, and its mobile channel, including its mobile Internet website and mobile Internet and value-added services ("MIVAS").

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Phoenix New Media's strategic and operational plans, contain forward-looking statements. Phoenix New Media may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission ("SEC") on Forms 20-F and 6-K in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Phoenix New Media's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company's goals and strategies; the Company's future business development, financial condition and results of operations; the expected growth of the online and mobile advertising, online video and mobile paid service markets in China; the Company's reliance on online advertising and MIVAS for the majority of its total revenues; the Company's expectations regarding demand for and market acceptance of its services; the Company's expectations regarding the retention and strengthening of its relationships with advertisers, partners and customers; fluctuations in the Company's quarterly operating results; the Company's plans to enhance its user experience, infrastructure and service offerings; the Company's reliance on mobile operators in China to provide most of its MIVAS; changes by mobile operators in China to their policies for MIVAS; competition in its industry in China; and relevant government policies and regulations relating to the Company. Further information regarding these and other risks is included in the Company's filings with the SEC, including its registration statement on Form F-1, as amended, and its annual report on Form 20-F. All information provided in this press release and in the attachments is as of the date of this press release, and Phoenix New Media does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries please contact:

Phoenix New Media Limited

Matthew Zhao

Email: ir@ifeng.com

ICR, Inc.

Jeremy Peruski

Tel: +1 (646) 405-4883

Email: Jeremy.peruski@icrinc.comhich was previously a separate component of paid service.

[2] The Company recognized share-based compensation, net of estimated forfeiture rates, on a graded vesting basis over the vesting term. Total share-based compensation for the fourth quarter of 2012 was negative RMB2.1 million. Negative share-based compensation expenses incurred were due to managements' estimate adjustment of the forfeiture rate for the restricted share units granted.

[3] An explanation of the Company's non-GAAP financial measures is included in the section entitled "Use of Non-GAAP Financial Measures" below, and the related reconciliations to GAAP financial measures are presented in the accompanying "Reconciliations of Non-GAAP Results of Operation Measures to the Nearest Comparable GAAP Measures".

[4] "ADS" is American Depositary Share. Each ADS represents eight ordinary shares.