HONG KONG--(BUSINESS WIRE)--Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three month and six month periods ended 30 June 2021. (All amounts are expressed in Hong Kong dollars unless otherwise stated)

LETTER FROM THE CHAIRMAN OF GALAXY ENTERTAINMENT GROUP

I appreciate the opportunity to update you on GEG’s most recent activities and financial results for the second quarter and first half of 2021. Macau continues to gradually recover and effectively navigate through the pandemic. The Macau market experienced its fourth consecutive quarter of gross gaming revenue (“GGR”) growth despite sporadic outbreaks of COVID-19 in Mainland and, most recently, in Macau. We are pleased to report that the primary focus of the Macau Government as well as GEG continues to be the health and safety of the public as well as social and economic stability.

In early August 2021, Macau reported four positive cases of COVID-19. We are pleased to report that the Macau Government acted promptly and decisively by testing the Macau community of over 700,000 for COVID-19 within three days, which is a remarkable achievement. Thankfully, the results of the mass screening were all negative. We would also like to acknowledge the Macau community’s cooperation in this important process which ensured swift execution of this monumental task. In addition, we would like to thank the Central Government who arranged for 300 healthcare personnel from the Mainland to assist in this critical effort, among others. Following this testing, the validity period of a negative test has been extended from 12 hours to 48 hours for individuals crossing the Guangdong-Macau border. GEG continues to support the Macau Government’s efforts including, among others, providing on-site vaccination facilities and education programs to actively encourage our staff and their family members to support Macau’s vaccination efforts to achieve herd immunity as well as on site COVID-19 testing facilities. Our in-house, on-site vaccination program has encouraged over 12,000 team members and their families to be vaccinated or registered to receive a vaccine.

Moving onto our Q2 2021 performance, Group Net Revenue of $5.6 billion improved relative to $1.2 billion in Q2 2020 and $5.1 billion in Q1 2021. Group Adjusted EBITDA of $1.1 billion also grew vs the $1.4 billion loss in Q2 2020 and was up 32% quarter-on-quarter. We are also pleased to report that our non-gaming performance improved in Q2 2021 due to a strong performance in retail which bodes well for the overall recovery prospects for Macau. Further, our performance was also supported by continued effective cost controls measures across the Group. Our balance sheet remains liquid and healthy. As of 30 June 2021, cash and liquid investments were $43.0 billion and net cash was $31.6 billion. Total debt was $11.4 billion at 30 June 2021, including $10.9 billion associated with our treasury yield enhancement program and $0.5 billion of core debt. This provides us with valuable flexibility in managing operations and supporting our development initiatives. Given the ongoing impact of COVID-19, today the Board of Directors has decided not to declare a dividend.

Moving on to our development update beginning with Cotai Phases 3 and 4 where we continue to invest in the future of Macau. We were pleased to announce in March 2021 the introduction of the legendary Raffles at Galaxy Macau which will feature an approximate 450 all-suite tower and is targeted to open in early 2022. We intend to follow this with the opening of the Galaxy International Convention Center and Andaz Macau in anticipation of the recovery of the MICE and entertainment markets. And, finally, we are proceeding with the construction of Cotai Phase 4, our next generation integrated resort, which will complete our ecosystem in Cotai. As you can see, we remain highly confident about the future of Macau where Cotai Phases 3 and 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

Regarding our development plan in Hengqin, we are awaiting updates from the government and would welcome the opportunity to contribute to the evolving role of Hengqin in Macau’s future. In addition, we are expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area. We, along with Monte-Carlo SBM from the Principality of Monaco remain interested in the long term prospects of Japan and are confident that they will successfully navigate through the COVID-19 pandemic.

We are very pleased to report that TripAdvisor recently announced that The Ritz-Carlton, Macau at Galaxy Macau™ was awarded the highest honor - Best of the Best Award, ranking No. 1 in the Top 25 Hotels in China and was also ranked No.14 in the Top 25 Hotels Worldwide.

This year also marks the 100th anniversary of the Communist Party of China (CPC). The CPC has successfully guided China on a path of sustainable development, having achieved admirable success that has earned global respect. GEG would like to deliver our congratulations to our nation. Unfortunately, Henan Province recently experienced a natural disaster in July. We wish a speedy recovery to all those affected by this tragedy and GEG contributed MOP10 million to support the emergency response and relief efforts in Henan Province.

Finally, I would like to acknowledge the efforts of the health and emergency personnel who have worked so hard to ensure the safety of Macau community. I would also like to thank our staff for being so supportive of our Company during these challenging times. Our future remains very bright!

Dr. Lui Che Woo

GBM, MBE, JP, LLD, DSSc, DBA

Chairman

|

Q2 & INTERIM 2021 RESULTS HIGHLIGHTS

GEG: Gradual Pandemic Recovery Continues Supported by Continued Effective Cost Control

Galaxy Macau™: Gradual Pandemic Recovery Continues

StarWorld Macau: Gradual Pandemic Recovery Continues

Broadway Macau™: A Unique Family Friendly Resort, Strongly Supported By Macau SMEs

Balance Sheet: Maintain a Healthy and Liquid Balance Sheet

Development Update: Continue Making Progress on Cotai Phases 3 & 4

|

Market Overview

Macau market experienced its fourth consecutive quarter of GGR growth in Q2 2021 despite sporadic outbreaks of COVID-19 in Mainland and, most recently, in Macau. The primary focus of the Macau Government as well as GEG continues to be the health and safety of the public as well as social and economic stability. Based on DICJ reporting, Macau’s GGR for Q2 2021 was $24.6 billion, up 685% year-on-year and up 7% quarter-on-quarter.

The IVS was progressively reinstated through the third quarter of 2020 but border entry restrictions for international and Hong Kong tourists remained in place impacting visitor arrivals. In Q2 2021, visitor arrivals to Macau were 2.2 million Vs 50,000 visitors in Q2 2020 and up 26% quarter-on-quarter. Mainland visitor arrivals were 2.0 million Vs 46,000 visitors in Q2 2020 and up 28% quarter-on-quarter. In Q2 2021, overnight visitors were 1.1 million Vs 25,000 visitors in Q2 2020 and up 24% quarter-on-quarter.

We look forward to the easing of border controls for Hong Kong and international tourists. We would also welcome the progressively reinstatement of the electronic IVS and the resumption of group tours to Macau.

Group Financial Results

1H 2021

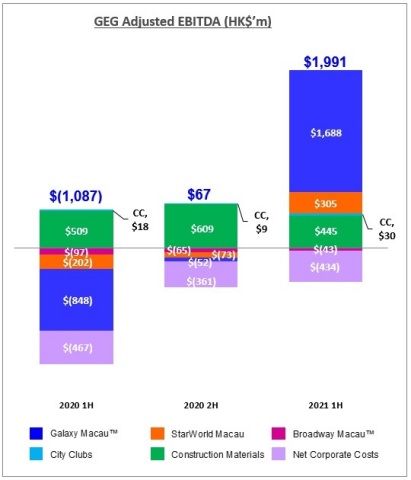

The Group’s 1H 2021 results posted Net Revenue of $10.7 billion, up 71% year-on-year and Adjusted EBITDA was $2.0 billion Vs $(1.1) billion in 1H 2020. Net profit attributable to shareholders was $0.9 billion Vs $(2.9) billion in 1H 2020. Galaxy Macau™’s Adjusted EBITDA was $1.7 billion Vs $(848) million in 1H 2020. StarWorld Macau’s Adjusted EBITDA was $305 million Vs $(202) million in 1H 2020. Broadway Macau™’s Adjusted EBITDA was $(43) million Vs $(97) million in 1H 2020.

During 1H 2021, GEG experienced good luck in its gaming operation, which increased its Adjusted EBITDA by approximately $243 million. Normalized 1H 2021 Adjusted EBITDA was $1.7 billion, Vs $(1.2) billion in 1H 2020.

The Group’s total GGR on a management basis 1 in 1H 2021 was $9.7 billion, up 62% year-on-year as total mass table GGR was $5.9 billion, up 100% year-on-year and total VIP GGR was $3.5 billion, up 26% year-on-year. Total electronic GGR was $333 million, up 27% year-on-year.

|

Group Key Financial Data |

|

|

||

|

(HK$'m) |

1H 2020 |

1H 2021 |

||

|

Revenues: |

|

|

||

|

Net Gaming |

4,322 |

7,841 |

||

|

Non-gaming |

679 |

1,389 |

||

|

Construction Materials |

1,222 |

1,431 |

||

|

Total Net Revenue |

6,223 |

10,661 |

||

|

Adjusted EBITDA |

(1,087) |

1,991 |

||

|

|

|

|

||

|

Gaming Statistics2 |

|

|

||

|

(HK$'m) |

1H 2020 |

1H 2021 |

||

|

Rolling Chip Volume3 |

74,873 |

83,943 |

||

|

Win Rate % |

3.7% |

4.2% |

||

|

Win |

2,790 |

3,506 |

||

|

|

|

|||

|

Mass Table Drop4 |

11,971 |

24,465 |

||

|

Win Rate % |

24.7% |

24.2% |

||

|

Win |

2,953 |

5,910 |

||

|

|

|

|||

|

Electronic Gaming Volume |

8,485 |

8,996 |

||

|

Win Rate % |

3.1% |

3.7% |

||

|

Win |

263 |

333 |

||

|

|

|

|

||

|

Total GGR Win5 |

6,006 |

9,749 |

Q2 2021

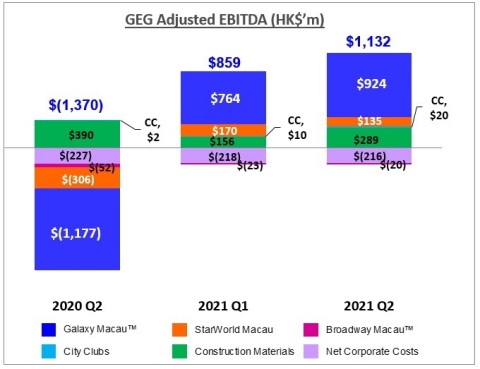

In Q2 2021, the Group’s Net Revenue was $5.6 billion, Vs $1.2 billion in Q2 2020 and was up 9% quarter-on-quarter. Adjusted EBITDA was $1.1 billion Vs $(1.4) billion in Q2 2020 and $859 million in Q1 2021. Galaxy Macau™’s Adjusted EBITDA was $924 million Vs $(1.2) billion in Q2 2020 and $764 million in Q1 2021. StarWorld Macau’s Adjusted EBITDA was $135 million Vs $(306) million in Q2 2020 and $170 million in Q1 2021. Broadway Macau™’s Adjusted EBITDA was $(20) million Vs $(52) million in Q2 2020 and $(23) million in Q1 2021.

Latest twelve months Adjusted EBITDA was $2.1 billion, Vs $7.1 billion in Q2 2020 and $(444) million in Q1 2021.

During Q2 2021, GEG experienced good luck in its gaming operations which increased Adjusted EBITDA by approximately $74 million. Normalized Q2 2021 Adjusted EBITDA was $1.1 billion, Vs $(1.4) billion in Q2 2020 and $690 million in Q1 2021.

The Group’s total GGR on a management basis6 in Q2 2021 was $5.0 billion, Vs $485 million in Q2 2020 and $4.8 billion in Q1 2021. Total mass table GGR was $3.1 billion, Vs $138 million in Q2 2020 and $2.8 billion in Q1 2021. Total VIP GGR was $1.7 billion, Vs $315 million in Q2 2020 and $1.8 billion in Q1 2021. Total electronic GGR was $203 million, Vs $32 million in Q2 2020 and $130 million in Q1 2021.

|

|

Group Key Financial Data |

|

|

|

|

|

|||||||||||

|

|

(HK$'m) |

|

|

|

|

|

|||||||||||

|

|

Q2 2020 |

Q1 2021 |

Q2 2021 |

1H 2020 |

1H 2021 |

||||||||||||

|

|

Revenues: |

|

|

|

|

|

|||||||||||

|

|

Net Gaming |

276 |

3,857 |

3,984 |

4,322 |

7,841 |

|||||||||||

|

|

Non-gaming |

130 |

598 |

791 |

679 |

1,389 |

|||||||||||

|

|

Construction Materials |

747 |

641 |

790 |

1,222 |

1,431 |

|||||||||||

|

|

Total Net Revenue |

1,153 |

5,096 |

5,565 |

6,223 |

10,661 |

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

Adjusted EBITDA |

(1,370) |

859 |

1,132 |

(1,087) |

1,991 |

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

Gaming Statistics7 |

|

|

|

|

|

|

||||||||||

|

|

(HK$'m) |

|

|

|

|

|

|

||||||||||

|

|

Q2 2020 |

Q1 2021 |

Q2 2021 |

1H 2020 |

1H 2021 |

|

|||||||||||

|

|

Rolling Chip Volume8 |

6,704 |

47,235 |

36,708 |

74,873 |

83,943 |

|

||||||||||

|

|

Win Rate % |

4.7% |

3.8% |

4.6% |

3.7% |

4.2% |

|

||||||||||

|

|

Win |

315 |

1,812 |

1,694 |

2,790 |

3,506 |

|

||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

Mass Table Drop9 |

782 |

11,585 |

12,880 |

11,971 |

24,465 |

|

||||||||||

|

|

Win Rate % |

17.6% |

24.6% |

23.8% |

24.7% |

24.2% |

|

||||||||||

|

|

Win |

138 |

2,849 |

3,061 |

2,953 |

5,910 |

|

||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

Electronic Gaming Volume |

1,366 |

4,195 |

4,801 |

8,485 |

8,996 |

|

||||||||||

|

|

Win Rate % |

2.4% |

3.1% |

4.2% |

3.1% |

3.7% |

|

||||||||||

|

|

Win |

32 |

130 |

203 |

263 |

333 |

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Total GGR Win10 |

485 |

4,791 |

4,958 |

6,006 |

9,749 |

|

||||||||||

Balance Sheet and Dividend

The Group’s balance sheet remains liquid and healthy. As of 30 June 2021, cash and liquid investments were $43.0 billion and net cash was $31.6 billion. Total debt was $11.4 billion as at 30 June 2021, including $10.9 billion associated with our treasury yield enhancement program and $0.5 billion of core debt. Given the ongoing impact of COVID-19, today the Board of Directors has decided not to declare a dividend.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to the Group’s revenue and earnings. Net Revenue in 1H 2021 was $7.2 billion, up 88% year-on-year. Adjusted EBITDA was $1.7 billion Vs $(848) million in 1H 2020.

Galaxy Macau™ experienced good luck in its gaming operations which increased its Adjusted EBITDA by approximately $213 million in 1H 2021. Normalized 1H 2021 Adjusted EBITDA was $1.5 billion, Vs $(933) million in 1H 2020.

Q2 2021 Adjusted EBITDA was $924 million Vs $(1.2) billion in Q2 2020 and $764 million in Q1 2021.

Galaxy Macau™ experienced good luck in its gaming operations which increased its Adjusted EBITDA by approximately $86 million in Q2 2021. Normalized Q2 2021 Adjusted EBITDA was $838 million, Vs $(1.2) billion in Q2 2020 and $637 million in Q1 2021.

The combined five hotels occupancy rate was 48% for 1H 2021 and 53% for Q2 2021.

|

Galaxy Macau™ Key Financial Data |

|||||

|

(HK$'m) |

Q2 2020 |

Q1 2021 |

Q2 2021 |

1H 2020 |

1H 2021 |

|

Revenues: |

|

|

|

|

|

|

Net Gaming |

200 |

2,875 |

3,079 |

3,260 |

5,954 |

|

Hotel / F&B / Others |

60 |

250 |

307 |

373 |

557 |

|

Mall |

51 |

292 |

423 |

202 |

715 |

|

Total Net Revenue |

311 |

3,417 |

3,809 |

3,835 |

7,226 |

|

Adjusted EBITDA |

(1,177) |

764 |

924 |

(848) |

1,688 |

|

Adjusted EBITDA Margin |

NEG11 |

22% |

24% |

NEG11 |

23% |

|

Gaming Statistics12 |

|

|

|

|

|

|

(HK$'m) |

Q2 2020 |

Q1 2021 |

Q2 2021 |

1H 2020 |

1H 2021 |

|

Rolling Chip Volume13 |

5,040 |

32,612 |

24,582 |

52,882 |

57,194 |

|

Win Rate % |

4.9% |

4.0% |

5.4% |

4.2% |

4.6% |

|

Win |

246 |

1,301 |

1,331 |

2,208 |

2,632 |

|

|

|

|

|

|

|

|

Mass Table Drop14 |

267 |

7,128 |

7,972 |

6,786 |

15,100 |

|

Win Rate % |

25.6% |

28.3% |

27.8% |

29.0% |

28.1% |

|

Win |

69 |

2,019 |

2,219 |

1,966 |

4,238 |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

463 |

3,167 |

3,513 |

4,945 |

6,680 |

|

Win Rate % |

2.9% |

3.2% |

4.9% |

3.9% |

4.1% |

|

Win |

14 |

102 |

174 |

192 |

276 |

|

|

|

|

|

|

|

|

Total GGR Win |

329 |

3,422 |

3,724 |

4,366 |

7,146 |

StarWorld Macau

StarWorld Macau’s Net Revenue was $1.9 billion in 1H 2021, up 80% year-on-year. Adjusted EBITDA was $305 million Vs $(202) million in 1H 2020.

StarWorld Macau experienced good luck in its gaming operations which increased its Adjusted EBITDA by approximately $30 million in 1H 2021. Normalized 1H 2021 Adjusted EBITDA was $275 million, Vs $(205) million in 1H 2020.

Q2 2021 Adjusted EBITDA was $135 million Vs $(306) million in Q2 2020 and $170 million in Q1 2021.

StarWorld Macau experienced bad luck in its gaming operations which decreased its Adjusted EBITDA by approximately $12 million in Q2 2021. Normalized Q2 2021 Adjusted EBITDA was $147 million, Vs $(297) million in Q2 2020 and $128 million in Q1 2021.

Hotel occupancy was 69% for 1H 2021 and 77% for Q2 2021.

|

StarWorld Macau Key Financial Data |

|||||

|

(HK$’m) |

Q2 2020 |

Q1 2021 |

Q2 2021 |

1H 2020 |

1H 2021 |

|

Revenues: |

|

|

|

|

|

|

Net Gaming |

73 |

972 |

885 |

1,021 |

1,857 |

|

Hotel / F&B / Others |

5 |

34 |

40 |

54 |

74 |

|

Mall |

3 |

7 |

7 |

8 |

14 |

|

Total Net Revenue |

81 |

1,013 |

932 |

1,083 |

1,945 |

|

Adjusted EBITDA |

(306) |

170 |

135 |

(202) |

305 |

|

Adjusted EBITDA Margin |

NEG15 |

17% |

14% |

NEG15 |

16% |

|

Gaming Statistics16 |

|

|

|

|

|

|

(HK$'m) |

Q2 2020 |

Q1 2021 |

Q2 2021 |

1H 2020 |

1H 2021 |

|

Rolling Chip Volume17 |

1,216 |

13,683 |

12,126 |

19,725 |

25,809 |

|

Win Rate % |

4.9% |

3.4% |

3.0% |

2.6% |

3.2% |

|

Win |

60 |

470 |

363 |

511 |

833 |

|

|

|

|

|

|

|

|

Mass Table Drop18 |

314 |

3,790 |

4,064 |

3,898 |

7,854 |

|

Win Rate % |

11.9% |

19.2% |

17.3% |

19.5% |

18.2% |

|

Win |

37 |

727 |

702 |

762 |

1,429 |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

211 |

520 |

664 |

1,360 |

1,184 |

|

Win Rate % |

2.6% |

3.5% |

2.5% |

2.2% |

2.9% |

|

Win |

6 |

18 |

16 |

30 |

34 |

|

|

|

|

|

|

|

|

Total GGR Win |

103 |

1,215 |

1,081 |

1,303 |

2,296 |

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs. The property’s Net Revenue was $29 million for 1H 2021 Vs $65 million for 1H 2020. Adjusted EBITDA was $(43) million for 1H 2021 Vs $(97) million in 1H 2020. There was no luck impact on Broadway Macau™’s Adjusted EBITDA in 1H 2021.

Q2 2021 Adjusted EBITDA was $(20) million Vs $(52) million in Q2 2020 and $(23) million in Q1 2021. There was no luck impact on Broadway Macau™’s Adjusted EBITDA in Q2 2021.

Hotel occupancy was 9% for 1H 2021 and was suspended in Q2 2021.

|

Broadway Macau™ Key Financial Data |

|||||

|

(HK$'m) |

|

|

|

|

|

|

Q2 2020 |

Q1 2021 |

Q2 2021 |

1H 2020 |

1H 2021 |

|

|

Revenues: |

|

|

|

|

|

|

Net Gaming |

1 |

0 |

0 |

23 |

0 |

|

Hotel / F&B / Others |

7 |

9 |

7 |

32 |

16 |

|

Mall |

4 |

6 |

7 |

10 |

13 |

|

Total Net Revenue |

12 |

15 |

14 |

65 |

29 |

|

Adjusted EBITDA |

(52) |

(23) |

(20) |

(97) |

(43) |

|

Adjusted EBITDA Margin |

NEG19 |

NEG19 |

NEG19 |

NEG19 |

NEG19 |

|

Gaming Statistics20 |

|

|

|

|

|

|

(HK$'m) |

|

|

|

|

|

|

Q2 2020 |

Q1 2021 |

Q2 2021 |

1H 2020 |

1H 2021 |

|

|

Mass Table Drop21 |

NIL |

NIL |

NIL |

114 |

NIL |

|

Win Rate % |

NIL |

NIL |

NIL |

17.9% |

NIL |

|

Win |

NIL |

NIL |

NIL |

20 |

NIL |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

74 |

13 |

3 |

294 |

16 |

|

Win Rate % |

2.1% |

3.5% |

6.6% |

2.1% |

4.0% |

|

Win |

1 |

0 |

1 |

6 |

1 |

|

|

|

|

|

|

|

|

Total GGR Win |

1 |

0 |

1 |

26 |

1 |

NIL represents tables closed during the period.

City Clubs

City Clubs contributed $30 million of Adjusted EBITDA to the Group’s earnings for 1H 2021, up 67% year-on-year. Q2 2021 Adjusted EBITDA was $20 million, Vs $2 million in Q2 2020 and $10 million in Q1 2021.

|

City Clubs Key Financial Data |

|||||

|

(HK$'m) |

|

|

|

|

|

|

Q2 2020 |

Q1 2021 |

Q2 2021 |

1H 2020 |

1H 2021 |

|

|

Adjusted EBITDA |

2 |

10 |

20 |

18 |

30 |

|

Gaming Statistics22 |

|

|

|

|

|

|

(HK$'m) |

|

|

|

|

|

|

|

Q2 2020 |

Q1 2021 |

Q2 2021 |

1H 2020 |

1H 2021 |

|

Rolling Chip Volume23 |

448 |

940 |

NIL |

2,266 |

940 |

|

Win Rate % |

2.0% |

4.4% |

NIL |

3.1% |

4.4% |

|

Win |

9 |

41 |

NIL |

71 |

41 |

|

|

|

|

|

|

|

|

Mass Table Drop24 |

201 |

667 |

844 |

1,173 |

1,511 |

|

Win Rate % |

15.6% |

15.4% |

16.7% |

17.4% |

16.1% |

|

Win |

32 |

103 |

140 |

205 |

243 |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

618 |

495 |

621 |

1,886 |

1,116 |

|

Win Rate % |

1.9% |

2.0% |

1.9% |

1.9% |

2.0% |

|

Win |

11 |

10 |

12 |

35 |

22 |

|

|

|

|

|

|

|

|

Total GGR Win |

52 |

154 |

152 |

311 |

306 |

NIL represents tables closed during the period.

Construction Materials Division

Construction Materials Division (“CMD”) contributed Adjusted EBITDA of $445 million in 1H 2021, down 13% year-on-year. CMD delivered a solid performance in Q2 2021 with Adjusted EBITDA of $289 million, which was down 26% year-on-year and up 85% quarter-on-quarter. This is due primarily to solid results in Hong Kong and slag in the Mainland, despite increased competition for cement within the Mainland.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests.

Cotai – The Next Chapter

GEG is uniquely positioned for long term growth. We are proceeding with the development of Phases 3 & 4 and continue to review and refine plans to ensure a world-class optimal development. We see the premium market evolving with this segment preferring higher quality and more spacious rooms. Phases 3 & 4 combined will have approximately 3,000 high end and family rooms and villas, 400,000 square feet of MICE space, a 500,000 square feet 16,000-seat multi-purpose arena, F&B, retail and casinos, among others. We will try to maintain our development targets, however due to COVID-19, development timelines may be impacted. At this point we cannot quantify the impact but we will endeavor to maintain our schedule.

The Group was pleased to announce in March 2021 the signing of a collaboration agreement with Accor to introduce the renowned Raffles brand to Macau. We look forward to welcoming the iconic Raffles at Galaxy Macau through an exclusive 450 all-suite tower with a target opening in early 2022.

We intend to follow this with the opening of the Galaxy International Convention Center and Andaz Macau in anticipation of the recovery of the MICE and entertainment markets. And, finally, we continue to proceed with the construction of Cotai Phase 4, our next generation integrated resort, which will complete our ecosystem in Cotai. As you can see, we remain highly confident about the future of Macau where Cotai Phases 3 and 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

Greater Bay Area / Hengqin

Regarding our development plan in Hengqin, we are awaiting updates from the government and would welcome the opportunity to contribute to the evolving role of Hengqin in Macau’s future development. In addition, we are expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area.

International

Our Japan based team continues with our Japan development efforts even as they deal with the COVID-19 crisis. We view Japan as a long term growth opportunity that will complement our Macau operations and our other international expansion ambitions. GEG, together with Monte-Carlo SBM from the Principality of Monaco and our Japanese partners, remain interested in bringing our brand of World Class IRs to Japan.

Selected Major Awards in 1H 2021

|

Award |

Presenter |

|

|

GEG |

||

|

ESG Recognitions Ceremony 2021 - ESG Care Label 2021-2022 |

SocietyNext Foundation, UNESCO Hong Kong Association Glocal Peace Centre and Rotary Action Group for Peace Hong Kong & Macao Chapter |

|

|

Galaxy MacauTM |

||

|

2020 Macao Green Hotel Award – Silver Award - Galaxy Hotel |

Environmental Protection Bureau of Macau SAR Government |

|

|

Michelin One-star

Michelin Plate

2021 Particularly Pleasant Luxury Hotel

2021 Particularly Pleasant Top Class Comfort Hotel

|

Michelin Guide Hong Kong and Macau 2021 |

|

|

Best of the Best Awards Top 25 Hotels — China

Best of the Best Awards Top 25 Hotels — World

Travelers’ Choice Winner 2021

|

Tripadvisor |

|

|

Hotels.com Loved by Guests Award 2021

|

Hotels.com |

|

|

2021 Forbes Travel Guide Five-star Hotel

2021 Forbes Travel Guide Five-star Spa

2021 Forbes Travel Guide Five-star Restaurant

2021 Forbes Travel Guide- Health Security VERIFIED™

|

Forbes Travel Guide |

|

|

SCMP 100 Top Tables 2021

|

South China Morning Post |

|

|

Energy Saving Concept Award (Hotel Group) Hotel Group B (Excellence Award) |

Macau Energy Saving Activity 2020 |

|

|

StarWorld Macau |

||

|

Top Class Comfort Hotel Michelin Two-star Restaurant - Feng Wei Ju |

Michelin Guide Hong Kong and Macau 2021 |

|

|

SCMP 100 Top Tables 2021 - Feng Wei Ju |

South China Morning Post |

|

|

One-diamond Restaurant |

Black Pearl Restaurant Guide 2021 |

|

|

Broadway MacauTM |

||

|

Quality Tourism Services Accreditation Scheme – First Class Restaurant |

Macau Tourism Board |

|

|

|

|

|

Hotel Group B (Excellence Award) |

Macau Energy Saving Activity 2020 |

|

|

Michelin Plate - Wong Kun Sio Kung |

Michelin Guide Hong Kong and Macau 2021 |

|

|

Construction Materials Division |

||

|

The 19th Hong Kong Occupational Safety & Health Award – Safety Performance Award (Other Industries) – Outstanding

The 19th Hong Kong Occupational Safety & Health Award – Safety Management System Award (Other Industries) – Merit

The 19th Hong Kong Occupational Safety & Health Award - Safety Management System Award - Best Workplace Infection Control Measures Award (Other Industries) - Merit |

Occupational Safety and Health Council

|

|

|

Construction Industry Volunteer Award Scheme 2021 – Merit Award for Participation |

Construction Industry Sports and Volunteering Programme |

|

Outlook

GEG continues to remain confident in the medium to longer term outlook for Macau. In Q2 2021, the Macau market experienced its fourth consecutive quarter of GGR growth despite sporadic outbreaks of COVID-19 in Mainland. The primary focus of the Macau Government as well as GEG continues to be the health and safety of the public as well as social and economic stability which they have certainly demonstrated again during the early August 2021 outbreak in Macau. GEG continues to have a healthy and liquid balance sheet. We are driving every segment of our business by enhancing operational efficiencies and exercising prudent cost control especially under the current market conditions. Furthermore, we will continue to develop our team members through training and upskilling, which supports the Macau Government’s vision to develop Macau into a World Center of Tourism and Leisure.

We continue to upgrade Galaxy Macau™ and StarWorld Macau through our property enhancement program. The renovation of our existing properties, reconfiguration and introduction of new products to our resorts will ensure they remain highly competitive and appealing to our valuable guests. GEG is uniquely positioned to capitalize on future growth with Cotai Phases 3 & 4 which are specifically designed for the mass customer. As we mentioned, Cotai Phase 3 will be introduced in phases beginning with Raffles at Galaxy Macau, an exclusive 450 all-suite tower, which is targeted to open in early 2022 and will be followed by the opening of Galaxy International Convention Center including Andaz Macau. We are also proceeding with the construction of Phase 4, our next generation integrated resort which will complete our ecosystem in Cotai. These projects will support Macau’s economy in the near term and strategically position GEG for future growth. Additionally, we are also focusing on the Greater Bay Area, Hengqin and Japan development opportunities.

Since the outbreak of the pandemic in early 2020, the Macau Government, health authorities and the entire community should be commended for their outstanding achievement in managing the pandemic. GEG has been working diligently in regards to health, safety and hygiene so that our resorts are operationally ready when travel restrictions are further relaxed. We are looking forward to the return of normalized travel throughout the world.

We also look forward to the launching of the public consultation on the proposed amendments to Macau’s gaming law and on the concession reissuance process. Additionally, the Macau SAR Legislative Assembly election will take place on 12 September 2021.

We have great confidence in Macau and we continue with our development program. Our resorts and our ongoing investment in Cotai Phases 3 & 4 will continue to support Macau’s economy in both the near and longer term. Whilst we remain confident, we are conscious that the current and potential future flare ups of COVID-19 could impact the rate of Macau’s recovery and our future financial performance. GEG remains committed to support the Government’s vision to develop Macau into a World Center of Tourism and Leisure.

- END -

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award winning premium property.

The Group has the largest undeveloped landbank of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will double to more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG is also progressing plans for its Hengqin project and we are also expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM including Japan.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group, please visit www.galaxyentertainment.com

1 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the Group level the gaming statistics include Company owned resorts plus City Clubs.

2 Gaming statistics are presented before deducting commission and incentives.

3 Reflects junket rolling chip volume only.

4 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

6 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the group level the gaming statistics include Company owned resorts plus City Clubs.

7 Gaming statistics are presented before deducting commission and incentives.

8 Reflects junket rolling chip volume only.

9 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

10 Total GGR win includes gaming win from City Clubs.

11 NEG represents negative margin.

12 Gaming statistics are presented before deducting commission and incentives.

13 Reflects junket rolling chip volume only.

14 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

15 NEG represents negative margin.

16 Gaming statistics are presented before deducting commission and incentives.

17 Reflects junket rolling chip volume only.

18 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

19 NEG represents negative margin.

20 Gaming statistics are presented before deducting commission and incentives.

21 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

22 Gaming statistics are presented before deducting commission and incentives.

23 Reflects junket rolling chip volume only.

24 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.